Every Conversation Counts: What We Learned from 130 CX Leaders Across LatAm

Marketing Team

Dec 19, 2025

If you talk to CX and operations leaders right now, you’ll hear the same story: customer expectations keep rising, call volumes won’t sit still, and human-only call centers are already stretched to the edge. Even in Latin America, AI hype is everywhere—but proven, reliable LatAm AI customer experience stories are harder to find.

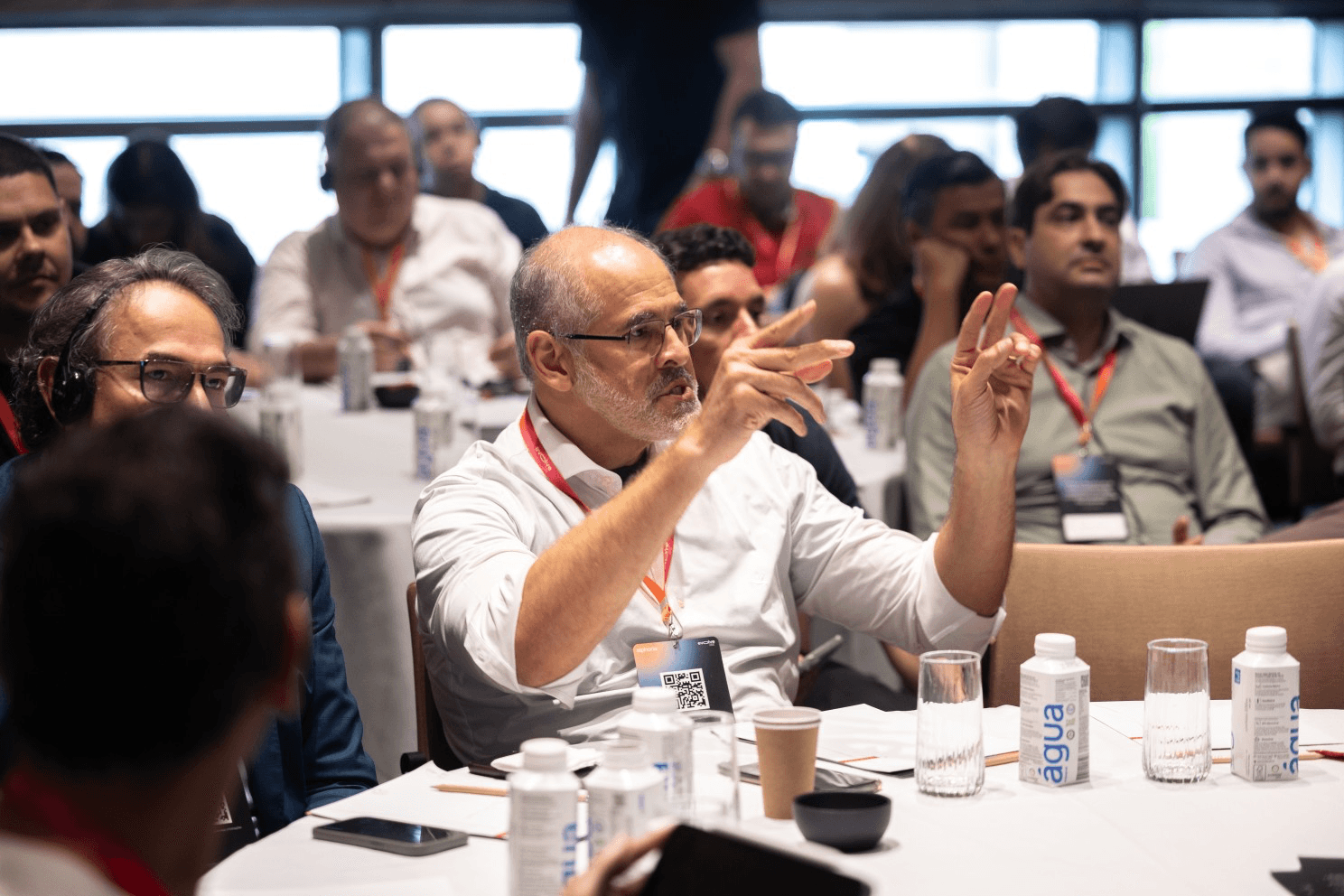

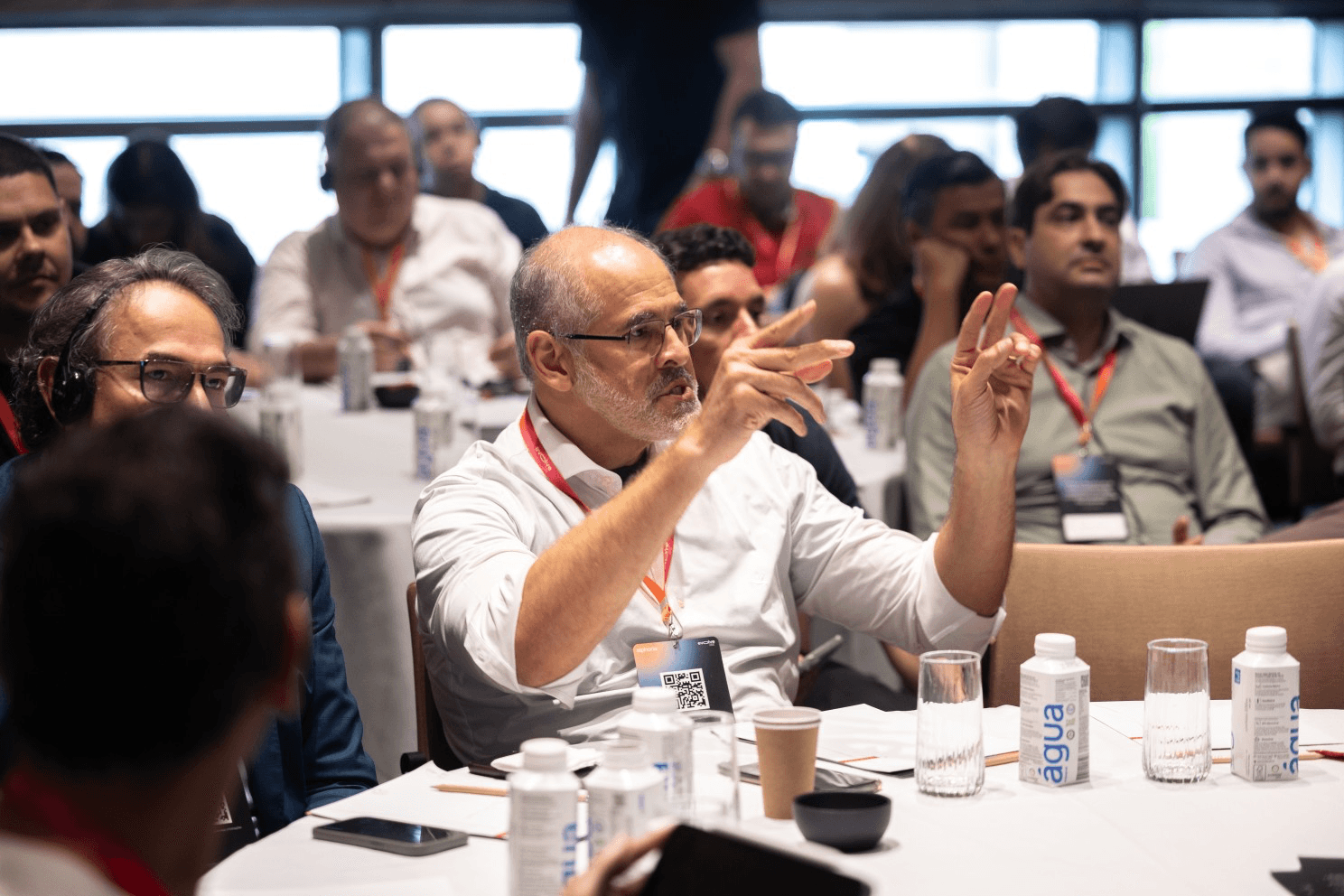

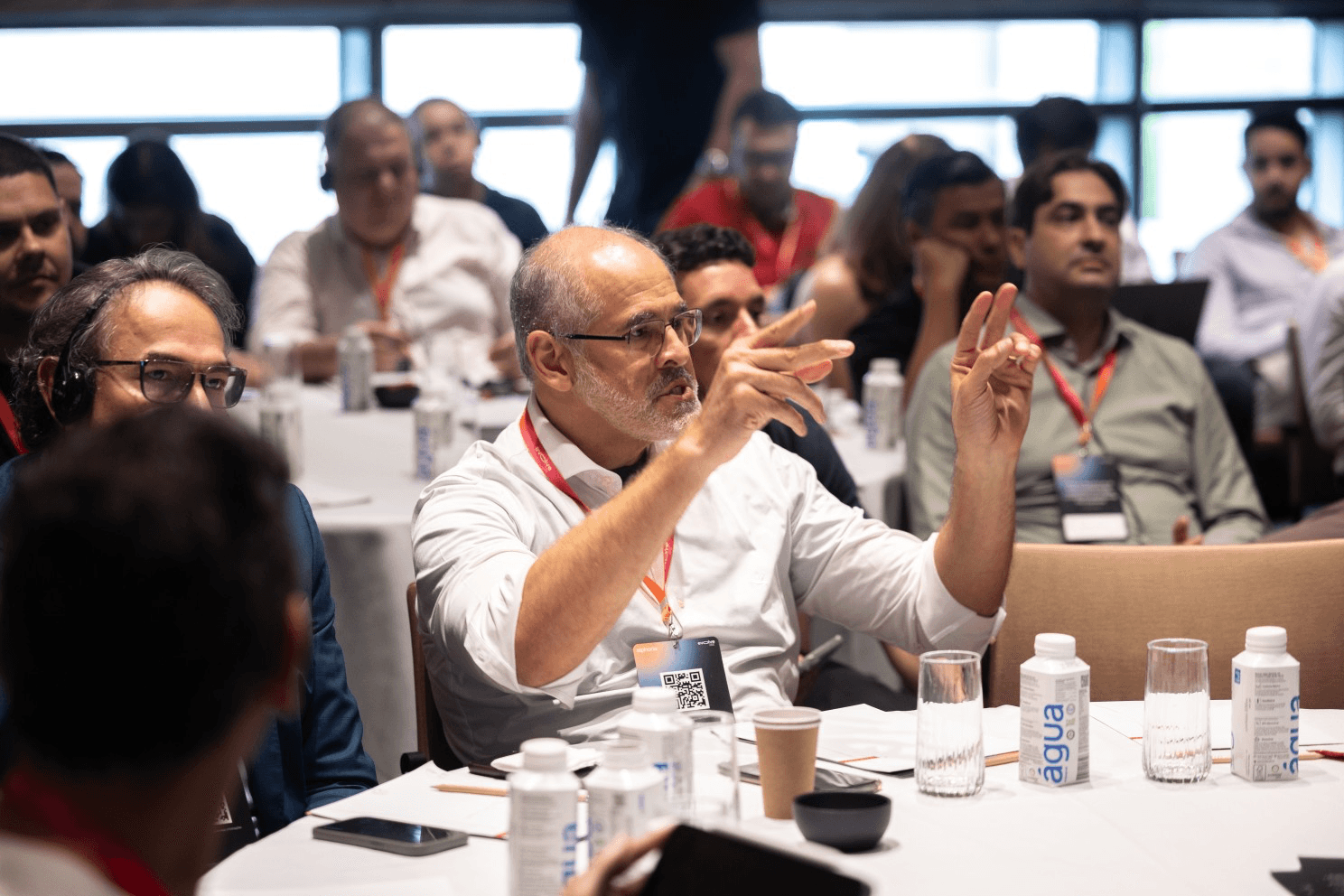

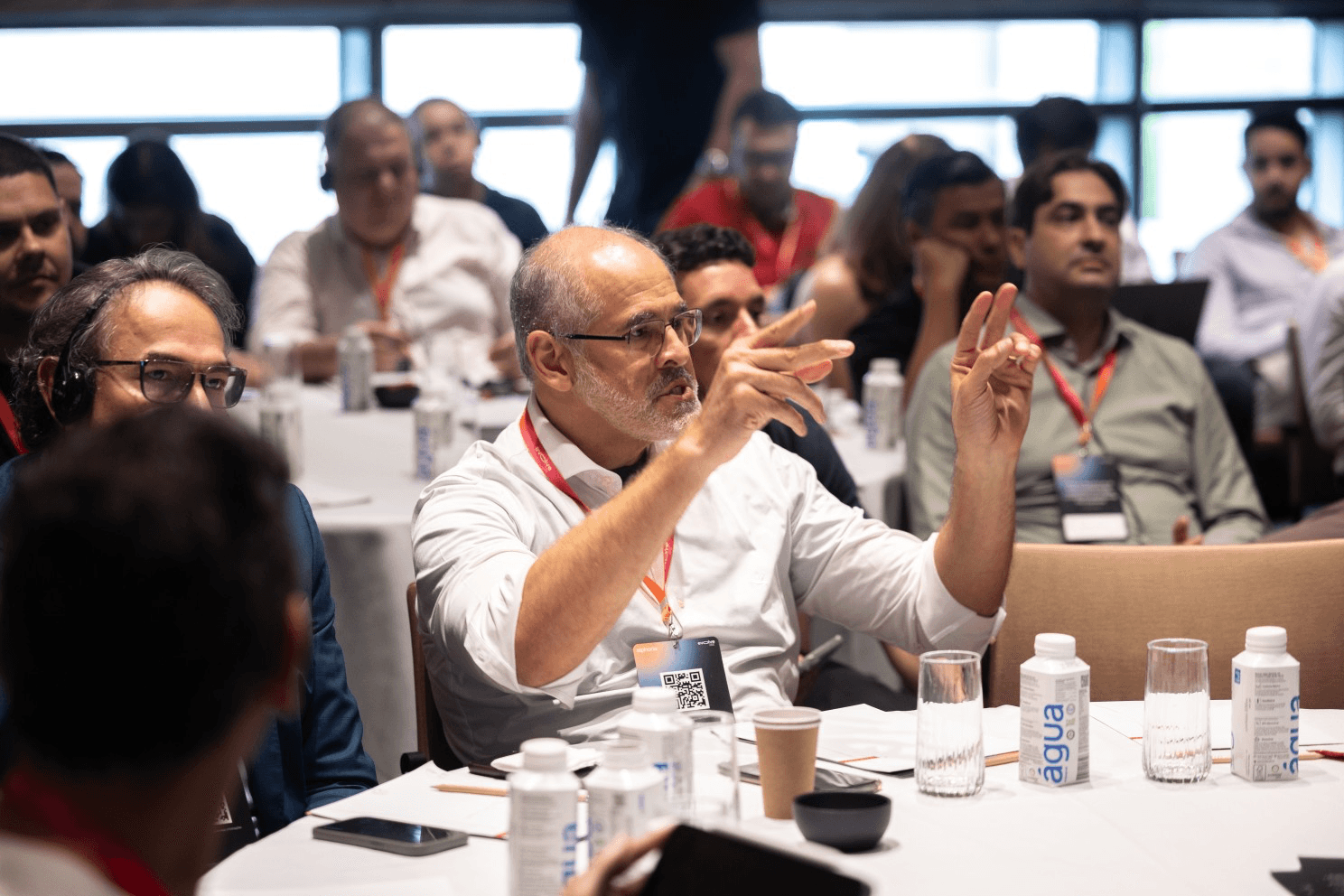

This is why we ran our LatAm workshop tour: to sit down with 130 CX leaders from over 130 companies in São Paulo, Bogotá, and Mexico City to talk about one simple idea—how an AI workforce in Latin America can help make every customer interaction count for revenue and relationships, not just call deflection.

Below is an in-depth recap of what we learned together.

Why we hit the road: the real AI gap in LatAm

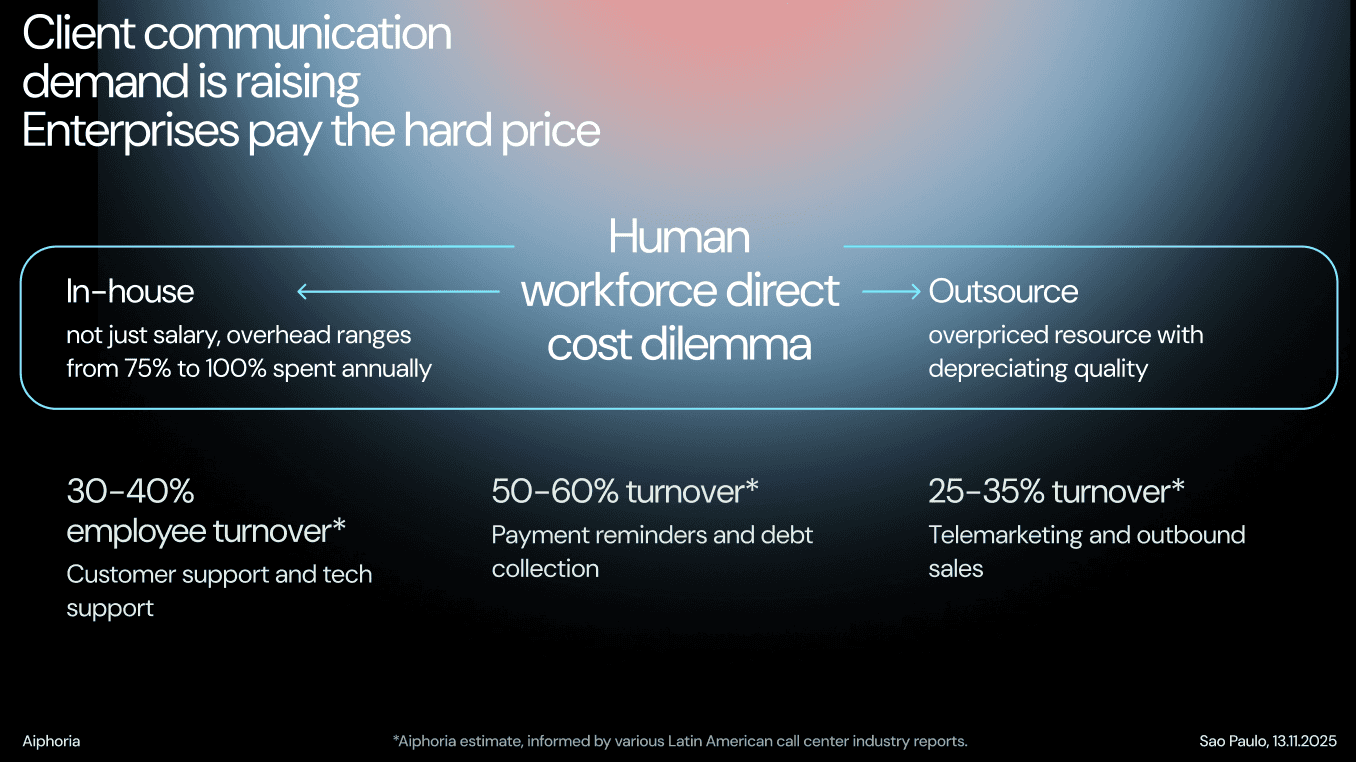

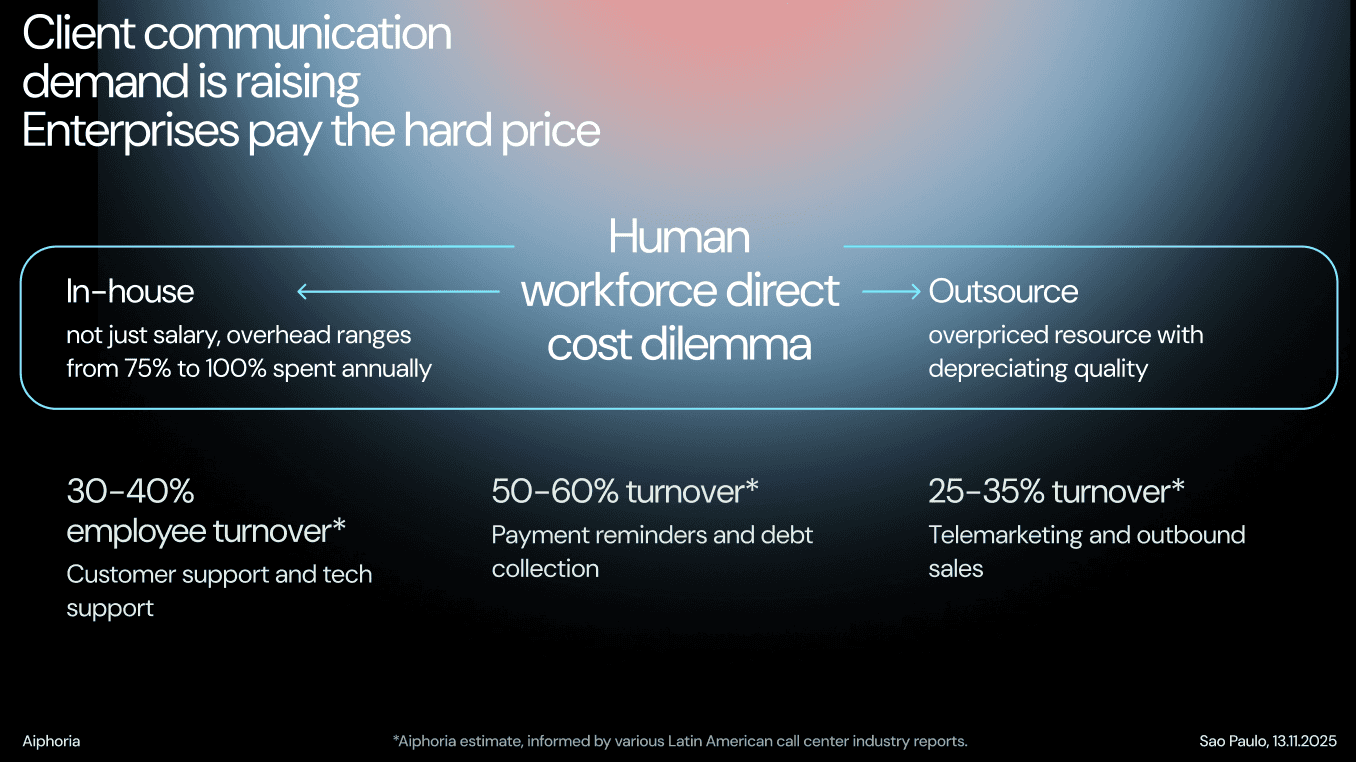

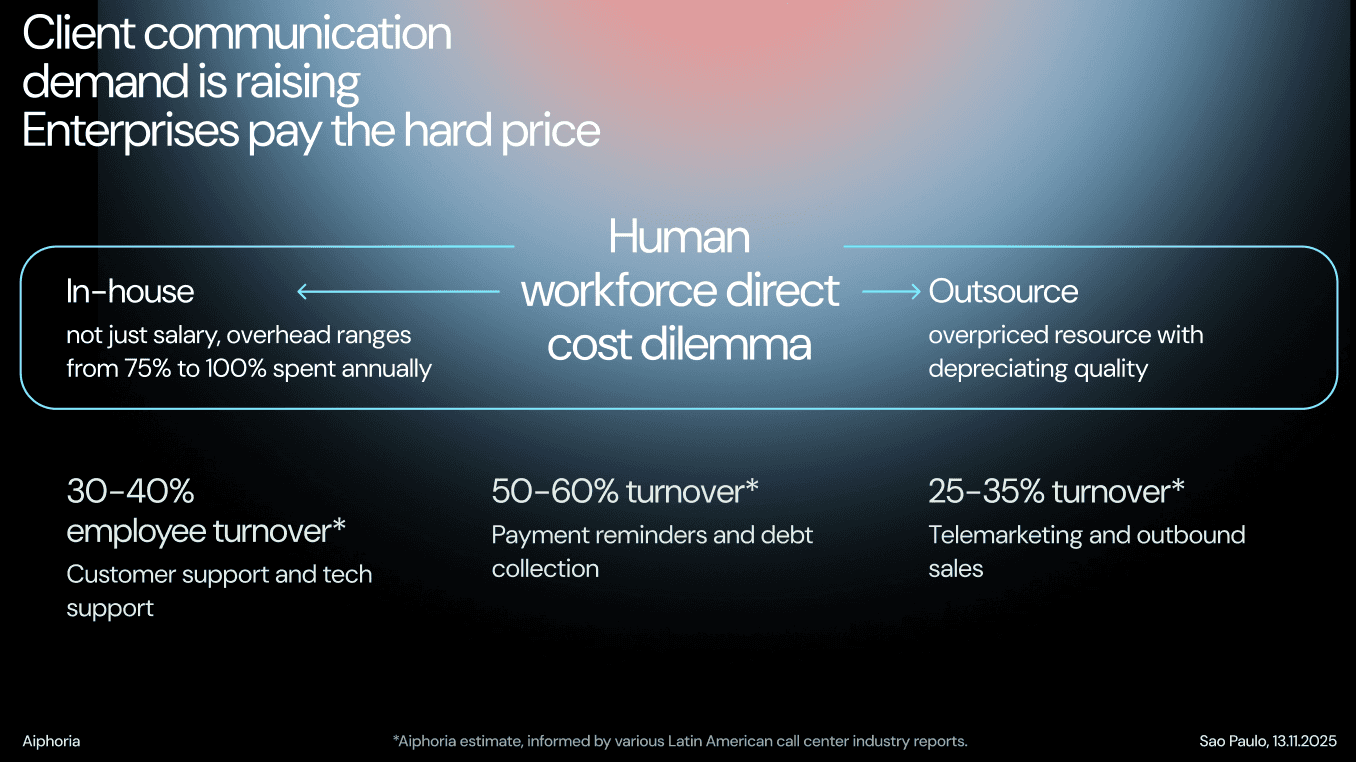

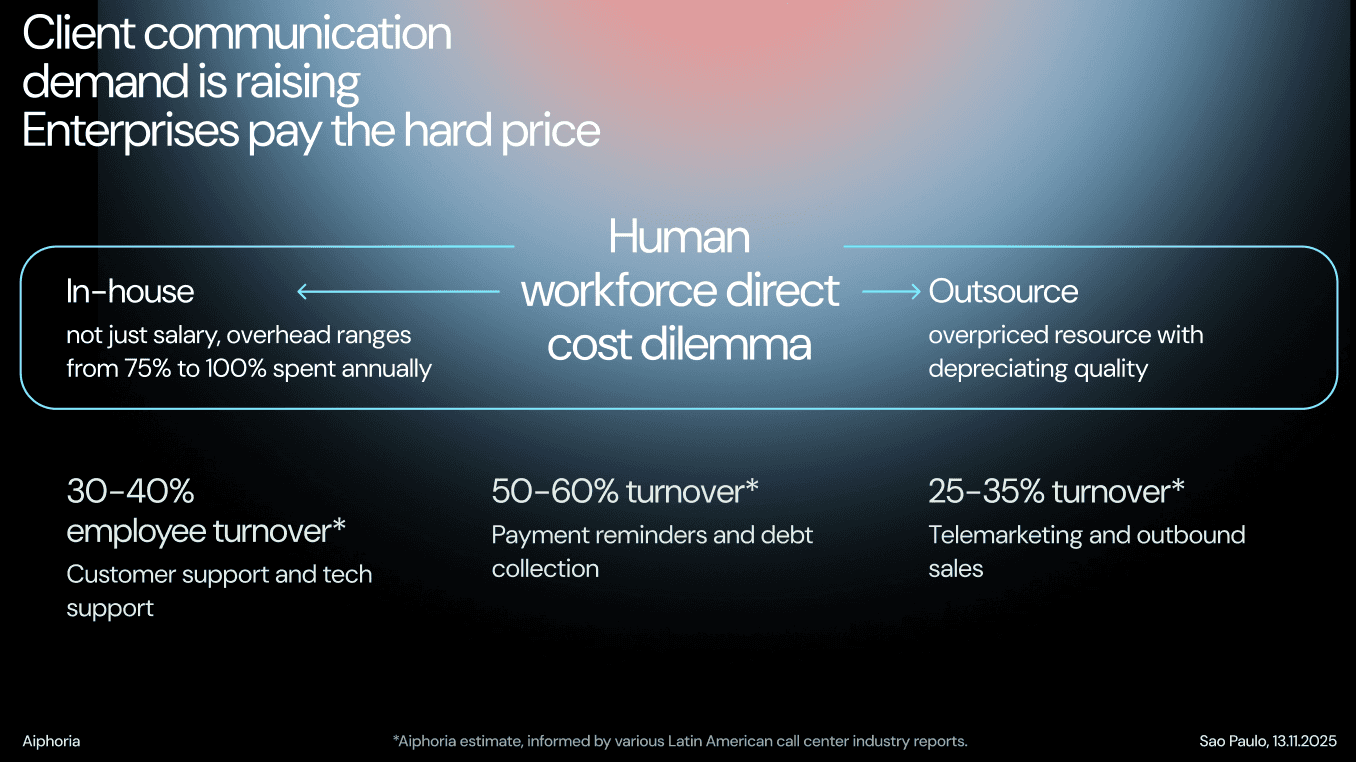

Across banking/fintech, retail and ecommerce, telco, and BPOs, leaders shared the same challenges:

Labor-heavy voice operations with high attrition and constant hiring pressure: recent global research pegs contact center turnover at 30–45% annually, with some sectors hitting 60%.

Demand spikes they can’t easily staff for: campaigns, due dates, system incidents, seasonal peaks.

A backlog of “AI projects” that looked promising in a demo, but never moved KPIs like recovery rates, NPS, or cost per contact.

LatAm is also a growth hotspot for CX and contact center innovation, with countries like Colombia and Mexico quickly becoming hubs for AI-driven customer operations.

In that context, the big gap we saw wasn’t interest in AI; everyone has that. The gap is between AI curiosity and AI that reliably solves real problems in AI for contact centers in LatAm.

Who we met: 130 leaders, one pattern

Across the three stops, we spoke with CX, collections, sales, and operations leaders from:

Large banks and fintechs managing high-volume collections and servicing

Telcos and ISPs with intense inbound volumes and frequent outages

Retail and ecommerce players fighting to protect loyalty in a price-sensitive market

BPOs and contact centers that live and die by utilization, quality, and SLAs

Their industries and customer bases looked different, but their goals were remarkably similar:

Recover more payments in a respectful, compliant way

Reduce contact center costs with AI without destroying customer trust

Increase sales conversion with AI agents in outbound and cross-sell flows

Deliver “zero wait time customer service” for routine journeys

That’s the lens through which we introduced the idea of an AI workforce for call centers.

What leaders actually want from AI (spoiler: not another chatbot)

Most participants had already tried or inherited some form of automation, such as IVRs, simple bots, and FAQ assistants. The feedback was blunt:

“We don’t need another toy. If we do this again, it has to move collections, churn, or sales. Otherwise, it’s just more complexity.”

Across cities, leaders converged around four requirements for LatAm AI customer experience projects:

Voice-first, not voice-bolted-on

Their most valuable interactions still happen on the phone.

Customers use slang, code-switch between languages, and interrupt often. Any voice AI platform has to be built for that reality, not adapted from text.

Goal-oriented, not chatty

They don’t want bots that talk; they want AI agents that resolve customer issues, secure promises-to-pay, book appointments, and qualify real leads.

Trustworthy by design

Legal, risk, and compliance teams need to know exactly what AI is allowed to say and do, and how it’s measured.

Fit into the stack they already have

No appetite for multi-year replatforming just to test one use case. Any omnichannel conversational AI has to integrate with existing telephony, CRMs, and core systems.

How we framed it: from human-only centers to an AI workforce in Latin America

Rather than leading with “AI agents” or model names, we talked about an AI workforce in Latin America in business terms:

AI workers that handle communication-heavy, repetitive tasks in collections, service, and sales

Humans focusing on complex negotiations, sensitive cases, and high-value relationships

This mirrors what we’ve written already about “virtual employees” and AI agents handling routine work at scale while humans tackle what they do best.

In the workshops, that translated into a clear distinction:

Not “let’s launch a chatbot,” but…

“Let’s give a collections worker a very specific job: reach past-due customers, explain their status, negotiate a payment or plan within guardrails, and confirm the outcome—across voice, SMS, or WhatsApp.”

For many participants, this shift—from channel or technology to job-to-be-done—was the first big unlock.

What we shared: a practical view of AI for contact centers in LatAm

What were the key learnings we were able to share at these CX workshops?

1. Real-world outcomes, not hypothetical ones

We brought anonymized and named examples (where approved) from banking and telco, including:

Collections programs where AI debt collection helped deliver up to 10x better efficiency per dollar spent compared with human-only operations. (Aiphoria)

Service and support deployments achieving up to 80% automation on targeted workflows while cutting response times to zero for many requests.

Sales initiatives where AI workers made new outbound and cross-sell channels economically viable—often at up to 50% lower cost per qualified conversation.

2. A simple mental model: when to use AI workers

We used three questions to identify where AI for customer service and collections in Latin America could most rapidly deliver value and augment human teams:

Is the journey high-volume and repetitive?

Is “success” easy to define and measure (payment, resolution, booking, activation)?

Are the rules and guardrails clear enough to encode?

Whenever the answer was “yes” to all three, the room could usually see a clear case for AI workers where people could absolutely stay in the loop but be freed from repetitive tasks. That way, they could focus their expertise on more complex, high-value work.

Voice-first, or why channels matter less than conversations

A big theme everywhere we visited: voice still dominates the highest-stakes interactions.

Independent research notes that AI-driven contact centers make the biggest experience impact when they let customers use natural language, instead of forcing them through rigid menus.

In LatAm, that means handling:

Fast, overlapping speech

Strong regional accents

Spanish-Portuguese mixes, and sometimes indigenous or local languages across other areas of Central and South America

This is where a voice-first AI platform differs from tools designed for text first:

Low-latency, incremental ASR that begins interpreting speech mid-utterance, enabling natural turn-taking without awkward pauses.

Hyper-realistic TTS that lets you tune tone by use case (firm in collections, reassuring in service, enthusiastic in sales)

Conversation design tied to goals and context, not just keywords

For leaders, the core benefit is simple: if the LatAm AI customer experience feels natural over the phone, it’s far easier to later extend the same logic to chat, apps, and messaging.

Trust and governance: top of mind in São Paulo, Bogotá, and Mexico City

If there was one topic that consistently pulled legal, risk, and IT into the discussion, it was governance.

We heard questions like:

“How do we make sure AI doesn’t say something our regulators would hate?”

“Who owns the AI ‘playbook’—you or us?”

“What happens when fraudsters start using AI voice too?”

Those concerns aren’t theoretical. Synthetic voice fraud is already targeting contact centers, exploiting weak verification and legacy defenses.

In response, we focused on three principles that matter for any enterprise-ready AI platform:

Transparent guardrails

Clear rules about what AI workers can and cannot say or do

Built-in escalation triggers for sensitive cases

End-to-end observability

Every interaction is logged, searchable, and reviewable

Analytics that show business outcomes (recoveries, resolutions, bookings), not just “AI handled X%”

Deployment and data control

Options like private cloud and on-premise deployments

Explicit handling of data residency for regulated industries

For many LatAm leaders, this was the moment AI shifted from “interesting experiment” to something they could imagine presenting to their boards and regulators.

What we heard from the room: patterns across LatAm

By the end of each workshop, the conversations got very specific. A few patterns came up again and again:

Collections leaders wanted to understand how to trial AI for debt collection in LatAm on a limited set of past-due buckets, measure lift, and gradually shift volume.

CX and service leaders gravitated toward “zero wait time customer service” for high-volume requests: account checks, order status, simple changes, FAQs.

Sales and marketing teams were curious about AI for outbound sales, especially in markets where agent costs and lead prices are rising.

BPOs and contact center outsourcers saw potential for an AI workforce layer they could offer to multiple clients while keeping humans focused on premium interactions.

Across roles and cities, the consensus was that AI workforce in Latin America isn’t about replacing humans; it’s about giving them room to breathe, and to focus on the interactions where human judgment really matters. That’s consistent with broader views in the region that AI augments agents, creating “super-agents” rather than eliminating people.

Where should CX leaders start?

If you’re reading this from a LatAm bank, telco, retailer, or BPO (or even from a North American one), the next move doesn’t have to be a massive transformation program.

Here’s a simple starting checklist we shared with attendees that can offer guidance:

Pick 1–2 high-volume journeys

Early-stage collections, appointment rescheduling, card activation, order status—anything simple, repetitive, and measurable.

Define “success” in plain language

e.g., “Increase early-stage recovery by X%,” “Cut wait times from 5–7 minutes to near-zero,” or “Reduce cost per qualified lead by half.”

Map your constraints and guardrails

Compliance rules, escalation triggers, languages and dialects, sensitive customer segments.

Assess your data and stack

What call recordings and outcome data do you already have?

Which systems (telephony, CRM, core platforms) any AI workforce platform would need to talk to?

Run a focused experiment, not a science project

Design a pilot with before/after measurement.

Involve CX, IT, and Risk from day one, so nobody is surprised later.

To sum up…

For many attendees, the tour was their first deep dive into:

Voice-first, goal-oriented AI agents designed as “virtual employees”

Concrete outcomes in AI for banks and fintech (particularly in collections and CX)

The architecture and governance needed to make this sustainable

These were collaborative working sessions that were extremely well-received by attendees. Why? Because they helped CX leaders understand the crucial difference between another “AI experiment” and adopting a truly purpose-built, voice-first AI platform that actually becomes an impactful part of an enterprise’s CX model.

If you’d like to learn how we can help you apply extraordinary voice-first AI to your enterprise’s CX challenges, just try a demo.

Other resources:

Our TBC Uzbekistan case study on AI applications in banking and autonomous collections

Our deep dive on AI in banking customer service and collections

A far-ranging review of AI taking over jobs (virtual employees) and what that really means for human beings

Why banks are “breaking up” with legacy customer-facing tech

Additional resources on AI debt collection and compliance in highly regulated markets

Anton Shestakov

Every Conversation Counts: What We Learned from 130 CX Leaders Across LatAm

Marketing Team

Dec 19, 2025

If you talk to CX and operations leaders right now, you’ll hear the same story: customer expectations keep rising, call volumes won’t sit still, and human-only call centers are already stretched to the edge. Even in Latin America, AI hype is everywhere—but proven, reliable LatAm AI customer experience stories are harder to find.

This is why we ran our LatAm workshop tour: to sit down with 130 CX leaders from over 130 companies in São Paulo, Bogotá, and Mexico City to talk about one simple idea—how an AI workforce in Latin America can help make every customer interaction count for revenue and relationships, not just call deflection.

Below is an in-depth recap of what we learned together.

Why we hit the road: the real AI gap in LatAm

Across banking/fintech, retail and ecommerce, telco, and BPOs, leaders shared the same challenges:

Labor-heavy voice operations with high attrition and constant hiring pressure: recent global research pegs contact center turnover at 30–45% annually, with some sectors hitting 60%.

Demand spikes they can’t easily staff for: campaigns, due dates, system incidents, seasonal peaks.

A backlog of “AI projects” that looked promising in a demo, but never moved KPIs like recovery rates, NPS, or cost per contact.

LatAm is also a growth hotspot for CX and contact center innovation, with countries like Colombia and Mexico quickly becoming hubs for AI-driven customer operations.

In that context, the big gap we saw wasn’t interest in AI; everyone has that. The gap is between AI curiosity and AI that reliably solves real problems in AI for contact centers in LatAm.

Who we met: 130 leaders, one pattern

Across the three stops, we spoke with CX, collections, sales, and operations leaders from:

Large banks and fintechs managing high-volume collections and servicing

Telcos and ISPs with intense inbound volumes and frequent outages

Retail and ecommerce players fighting to protect loyalty in a price-sensitive market

BPOs and contact centers that live and die by utilization, quality, and SLAs

Their industries and customer bases looked different, but their goals were remarkably similar:

Recover more payments in a respectful, compliant way

Reduce contact center costs with AI without destroying customer trust

Increase sales conversion with AI agents in outbound and cross-sell flows

Deliver “zero wait time customer service” for routine journeys

That’s the lens through which we introduced the idea of an AI workforce for call centers.

What leaders actually want from AI (spoiler: not another chatbot)

Most participants had already tried or inherited some form of automation, such as IVRs, simple bots, and FAQ assistants. The feedback was blunt:

“We don’t need another toy. If we do this again, it has to move collections, churn, or sales. Otherwise, it’s just more complexity.”

Across cities, leaders converged around four requirements for LatAm AI customer experience projects:

Voice-first, not voice-bolted-on

Their most valuable interactions still happen on the phone.

Customers use slang, code-switch between languages, and interrupt often. Any voice AI platform has to be built for that reality, not adapted from text.

Goal-oriented, not chatty

They don’t want bots that talk; they want AI agents that resolve customer issues, secure promises-to-pay, book appointments, and qualify real leads.

Trustworthy by design

Legal, risk, and compliance teams need to know exactly what AI is allowed to say and do, and how it’s measured.

Fit into the stack they already have

No appetite for multi-year replatforming just to test one use case. Any omnichannel conversational AI has to integrate with existing telephony, CRMs, and core systems.

How we framed it: from human-only centers to an AI workforce in Latin America

Rather than leading with “AI agents” or model names, we talked about an AI workforce in Latin America in business terms:

AI workers that handle communication-heavy, repetitive tasks in collections, service, and sales

Humans focusing on complex negotiations, sensitive cases, and high-value relationships

This mirrors what we’ve written already about “virtual employees” and AI agents handling routine work at scale while humans tackle what they do best.

In the workshops, that translated into a clear distinction:

Not “let’s launch a chatbot,” but…

“Let’s give a collections worker a very specific job: reach past-due customers, explain their status, negotiate a payment or plan within guardrails, and confirm the outcome—across voice, SMS, or WhatsApp.”

For many participants, this shift—from channel or technology to job-to-be-done—was the first big unlock.

What we shared: a practical view of AI for contact centers in LatAm

What were the key learnings we were able to share at these CX workshops?

1. Real-world outcomes, not hypothetical ones

We brought anonymized and named examples (where approved) from banking and telco, including:

Collections programs where AI debt collection helped deliver up to 10x better efficiency per dollar spent compared with human-only operations. (Aiphoria)

Service and support deployments achieving up to 80% automation on targeted workflows while cutting response times to zero for many requests.

Sales initiatives where AI workers made new outbound and cross-sell channels economically viable—often at up to 50% lower cost per qualified conversation.

2. A simple mental model: when to use AI workers

We used three questions to identify where AI for customer service and collections in Latin America could most rapidly deliver value and augment human teams:

Is the journey high-volume and repetitive?

Is “success” easy to define and measure (payment, resolution, booking, activation)?

Are the rules and guardrails clear enough to encode?

Whenever the answer was “yes” to all three, the room could usually see a clear case for AI workers where people could absolutely stay in the loop but be freed from repetitive tasks. That way, they could focus their expertise on more complex, high-value work.

Voice-first, or why channels matter less than conversations

A big theme everywhere we visited: voice still dominates the highest-stakes interactions.

Independent research notes that AI-driven contact centers make the biggest experience impact when they let customers use natural language, instead of forcing them through rigid menus.

In LatAm, that means handling:

Fast, overlapping speech

Strong regional accents

Spanish-Portuguese mixes, and sometimes indigenous or local languages across other areas of Central and South America

This is where a voice-first AI platform differs from tools designed for text first:

Low-latency, incremental ASR that begins interpreting speech mid-utterance, enabling natural turn-taking without awkward pauses.

Hyper-realistic TTS that lets you tune tone by use case (firm in collections, reassuring in service, enthusiastic in sales)

Conversation design tied to goals and context, not just keywords

For leaders, the core benefit is simple: if the LatAm AI customer experience feels natural over the phone, it’s far easier to later extend the same logic to chat, apps, and messaging.

Trust and governance: top of mind in São Paulo, Bogotá, and Mexico City

If there was one topic that consistently pulled legal, risk, and IT into the discussion, it was governance.

We heard questions like:

“How do we make sure AI doesn’t say something our regulators would hate?”

“Who owns the AI ‘playbook’—you or us?”

“What happens when fraudsters start using AI voice too?”

Those concerns aren’t theoretical. Synthetic voice fraud is already targeting contact centers, exploiting weak verification and legacy defenses.

In response, we focused on three principles that matter for any enterprise-ready AI platform:

Transparent guardrails

Clear rules about what AI workers can and cannot say or do

Built-in escalation triggers for sensitive cases

End-to-end observability

Every interaction is logged, searchable, and reviewable

Analytics that show business outcomes (recoveries, resolutions, bookings), not just “AI handled X%”

Deployment and data control

Options like private cloud and on-premise deployments

Explicit handling of data residency for regulated industries

For many LatAm leaders, this was the moment AI shifted from “interesting experiment” to something they could imagine presenting to their boards and regulators.

What we heard from the room: patterns across LatAm

By the end of each workshop, the conversations got very specific. A few patterns came up again and again:

Collections leaders wanted to understand how to trial AI for debt collection in LatAm on a limited set of past-due buckets, measure lift, and gradually shift volume.

CX and service leaders gravitated toward “zero wait time customer service” for high-volume requests: account checks, order status, simple changes, FAQs.

Sales and marketing teams were curious about AI for outbound sales, especially in markets where agent costs and lead prices are rising.

BPOs and contact center outsourcers saw potential for an AI workforce layer they could offer to multiple clients while keeping humans focused on premium interactions.

Across roles and cities, the consensus was that AI workforce in Latin America isn’t about replacing humans; it’s about giving them room to breathe, and to focus on the interactions where human judgment really matters. That’s consistent with broader views in the region that AI augments agents, creating “super-agents” rather than eliminating people.

Where should CX leaders start?

If you’re reading this from a LatAm bank, telco, retailer, or BPO (or even from a North American one), the next move doesn’t have to be a massive transformation program.

Here’s a simple starting checklist we shared with attendees that can offer guidance:

Pick 1–2 high-volume journeys

Early-stage collections, appointment rescheduling, card activation, order status—anything simple, repetitive, and measurable.

Define “success” in plain language

e.g., “Increase early-stage recovery by X%,” “Cut wait times from 5–7 minutes to near-zero,” or “Reduce cost per qualified lead by half.”

Map your constraints and guardrails

Compliance rules, escalation triggers, languages and dialects, sensitive customer segments.

Assess your data and stack

What call recordings and outcome data do you already have?

Which systems (telephony, CRM, core platforms) any AI workforce platform would need to talk to?

Run a focused experiment, not a science project

Design a pilot with before/after measurement.

Involve CX, IT, and Risk from day one, so nobody is surprised later.

To sum up…

For many attendees, the tour was their first deep dive into:

Voice-first, goal-oriented AI agents designed as “virtual employees”

Concrete outcomes in AI for banks and fintech (particularly in collections and CX)

The architecture and governance needed to make this sustainable

These were collaborative working sessions that were extremely well-received by attendees. Why? Because they helped CX leaders understand the crucial difference between another “AI experiment” and adopting a truly purpose-built, voice-first AI platform that actually becomes an impactful part of an enterprise’s CX model.

If you’d like to learn how we can help you apply extraordinary voice-first AI to your enterprise’s CX challenges, just try a demo.

Other resources:

Our TBC Uzbekistan case study on AI applications in banking and autonomous collections

Our deep dive on AI in banking customer service and collections

A far-ranging review of AI taking over jobs (virtual employees) and what that really means for human beings

Why banks are “breaking up” with legacy customer-facing tech

Additional resources on AI debt collection and compliance in highly regulated markets

Anton Shestakov

Every Conversation Counts: What We Learned from 130 CX Leaders Across LatAm

Every Conversation Counts: What We Learned from 130 CX Leaders Across LatAm

Marketing Team

Dec 19, 2025

If you talk to CX and operations leaders right now, you’ll hear the same story: customer expectations keep rising, call volumes won’t sit still, and human-only call centers are already stretched to the edge. Even in Latin America, AI hype is everywhere—but proven, reliable LatAm AI customer experience stories are harder to find.

This is why we ran our LatAm workshop tour: to sit down with 130 CX leaders from over 130 companies in São Paulo, Bogotá, and Mexico City to talk about one simple idea—how an AI workforce in Latin America can help make every customer interaction count for revenue and relationships, not just call deflection.

Below is an in-depth recap of what we learned together.

Why we hit the road: the real AI gap in LatAm

Across banking/fintech, retail and ecommerce, telco, and BPOs, leaders shared the same challenges:

Labor-heavy voice operations with high attrition and constant hiring pressure: recent global research pegs contact center turnover at 30–45% annually, with some sectors hitting 60%.

Demand spikes they can’t easily staff for: campaigns, due dates, system incidents, seasonal peaks.

A backlog of “AI projects” that looked promising in a demo, but never moved KPIs like recovery rates, NPS, or cost per contact.

LatAm is also a growth hotspot for CX and contact center innovation, with countries like Colombia and Mexico quickly becoming hubs for AI-driven customer operations.

In that context, the big gap we saw wasn’t interest in AI; everyone has that. The gap is between AI curiosity and AI that reliably solves real problems in AI for contact centers in LatAm.

Who we met: 130 leaders, one pattern

Across the three stops, we spoke with CX, collections, sales, and operations leaders from:

Large banks and fintechs managing high-volume collections and servicing

Telcos and ISPs with intense inbound volumes and frequent outages

Retail and ecommerce players fighting to protect loyalty in a price-sensitive market

BPOs and contact centers that live and die by utilization, quality, and SLAs

Their industries and customer bases looked different, but their goals were remarkably similar:

Recover more payments in a respectful, compliant way

Reduce contact center costs with AI without destroying customer trust

Increase sales conversion with AI agents in outbound and cross-sell flows

Deliver “zero wait time customer service” for routine journeys

That’s the lens through which we introduced the idea of an AI workforce for call centers.

What leaders actually want from AI (spoiler: not another chatbot)

Most participants had already tried or inherited some form of automation, such as IVRs, simple bots, and FAQ assistants. The feedback was blunt:

“We don’t need another toy. If we do this again, it has to move collections, churn, or sales. Otherwise, it’s just more complexity.”

Across cities, leaders converged around four requirements for LatAm AI customer experience projects:

Voice-first, not voice-bolted-on

Their most valuable interactions still happen on the phone.

Customers use slang, code-switch between languages, and interrupt often. Any voice AI platform has to be built for that reality, not adapted from text.

Goal-oriented, not chatty

They don’t want bots that talk; they want AI agents that resolve customer issues, secure promises-to-pay, book appointments, and qualify real leads.

Trustworthy by design

Legal, risk, and compliance teams need to know exactly what AI is allowed to say and do, and how it’s measured.

Fit into the stack they already have

No appetite for multi-year replatforming just to test one use case. Any omnichannel conversational AI has to integrate with existing telephony, CRMs, and core systems.

How we framed it: from human-only centers to an AI workforce in Latin America

Rather than leading with “AI agents” or model names, we talked about an AI workforce in Latin America in business terms:

AI workers that handle communication-heavy, repetitive tasks in collections, service, and sales

Humans focusing on complex negotiations, sensitive cases, and high-value relationships

This mirrors what we’ve written already about “virtual employees” and AI agents handling routine work at scale while humans tackle what they do best.

In the workshops, that translated into a clear distinction:

Not “let’s launch a chatbot,” but…

“Let’s give a collections worker a very specific job: reach past-due customers, explain their status, negotiate a payment or plan within guardrails, and confirm the outcome—across voice, SMS, or WhatsApp.”

For many participants, this shift—from channel or technology to job-to-be-done—was the first big unlock.

What we shared: a practical view of AI for contact centers in LatAm

What were the key learnings we were able to share at these CX workshops?

1. Real-world outcomes, not hypothetical ones

We brought anonymized and named examples (where approved) from banking and telco, including:

Collections programs where AI debt collection helped deliver up to 10x better efficiency per dollar spent compared with human-only operations. (Aiphoria)

Service and support deployments achieving up to 80% automation on targeted workflows while cutting response times to zero for many requests.

Sales initiatives where AI workers made new outbound and cross-sell channels economically viable—often at up to 50% lower cost per qualified conversation.

2. A simple mental model: when to use AI workers

We used three questions to identify where AI for customer service and collections in Latin America could most rapidly deliver value and augment human teams:

Is the journey high-volume and repetitive?

Is “success” easy to define and measure (payment, resolution, booking, activation)?

Are the rules and guardrails clear enough to encode?

Whenever the answer was “yes” to all three, the room could usually see a clear case for AI workers where people could absolutely stay in the loop but be freed from repetitive tasks. That way, they could focus their expertise on more complex, high-value work.

Voice-first, or why channels matter less than conversations

A big theme everywhere we visited: voice still dominates the highest-stakes interactions.

Independent research notes that AI-driven contact centers make the biggest experience impact when they let customers use natural language, instead of forcing them through rigid menus.

In LatAm, that means handling:

Fast, overlapping speech

Strong regional accents

Spanish-Portuguese mixes, and sometimes indigenous or local languages across other areas of Central and South America

This is where a voice-first AI platform differs from tools designed for text first:

Low-latency, incremental ASR that begins interpreting speech mid-utterance, enabling natural turn-taking without awkward pauses.

Hyper-realistic TTS that lets you tune tone by use case (firm in collections, reassuring in service, enthusiastic in sales)

Conversation design tied to goals and context, not just keywords

For leaders, the core benefit is simple: if the LatAm AI customer experience feels natural over the phone, it’s far easier to later extend the same logic to chat, apps, and messaging.

Trust and governance: top of mind in São Paulo, Bogotá, and Mexico City

If there was one topic that consistently pulled legal, risk, and IT into the discussion, it was governance.

We heard questions like:

“How do we make sure AI doesn’t say something our regulators would hate?”

“Who owns the AI ‘playbook’—you or us?”

“What happens when fraudsters start using AI voice too?”

Those concerns aren’t theoretical. Synthetic voice fraud is already targeting contact centers, exploiting weak verification and legacy defenses.

In response, we focused on three principles that matter for any enterprise-ready AI platform:

Transparent guardrails

Clear rules about what AI workers can and cannot say or do

Built-in escalation triggers for sensitive cases

End-to-end observability

Every interaction is logged, searchable, and reviewable

Analytics that show business outcomes (recoveries, resolutions, bookings), not just “AI handled X%”

Deployment and data control

Options like private cloud and on-premise deployments

Explicit handling of data residency for regulated industries

For many LatAm leaders, this was the moment AI shifted from “interesting experiment” to something they could imagine presenting to their boards and regulators.

What we heard from the room: patterns across LatAm

By the end of each workshop, the conversations got very specific. A few patterns came up again and again:

Collections leaders wanted to understand how to trial AI for debt collection in LatAm on a limited set of past-due buckets, measure lift, and gradually shift volume.

CX and service leaders gravitated toward “zero wait time customer service” for high-volume requests: account checks, order status, simple changes, FAQs.

Sales and marketing teams were curious about AI for outbound sales, especially in markets where agent costs and lead prices are rising.

BPOs and contact center outsourcers saw potential for an AI workforce layer they could offer to multiple clients while keeping humans focused on premium interactions.

Across roles and cities, the consensus was that AI workforce in Latin America isn’t about replacing humans; it’s about giving them room to breathe, and to focus on the interactions where human judgment really matters. That’s consistent with broader views in the region that AI augments agents, creating “super-agents” rather than eliminating people.

Where should CX leaders start?

If you’re reading this from a LatAm bank, telco, retailer, or BPO (or even from a North American one), the next move doesn’t have to be a massive transformation program.

Here’s a simple starting checklist we shared with attendees that can offer guidance:

Pick 1–2 high-volume journeys

Early-stage collections, appointment rescheduling, card activation, order status—anything simple, repetitive, and measurable.

Define “success” in plain language

e.g., “Increase early-stage recovery by X%,” “Cut wait times from 5–7 minutes to near-zero,” or “Reduce cost per qualified lead by half.”

Map your constraints and guardrails

Compliance rules, escalation triggers, languages and dialects, sensitive customer segments.

Assess your data and stack

What call recordings and outcome data do you already have?

Which systems (telephony, CRM, core platforms) any AI workforce platform would need to talk to?

Run a focused experiment, not a science project

Design a pilot with before/after measurement.

Involve CX, IT, and Risk from day one, so nobody is surprised later.

To sum up…

For many attendees, the tour was their first deep dive into:

Voice-first, goal-oriented AI agents designed as “virtual employees”

Concrete outcomes in AI for banks and fintech (particularly in collections and CX)

The architecture and governance needed to make this sustainable

These were collaborative working sessions that were extremely well-received by attendees. Why? Because they helped CX leaders understand the crucial difference between another “AI experiment” and adopting a truly purpose-built, voice-first AI platform that actually becomes an impactful part of an enterprise’s CX model.

If you’d like to learn how we can help you apply extraordinary voice-first AI to your enterprise’s CX challenges, just try a demo.

Other resources:

Our TBC Uzbekistan case study on AI applications in banking and autonomous collections

Our deep dive on AI in banking customer service and collections

A far-ranging review of AI taking over jobs (virtual employees) and what that really means for human beings

Why banks are “breaking up” with legacy customer-facing tech

Additional resources on AI debt collection and compliance in highly regulated markets

If you talk to CX and operations leaders right now, you’ll hear the same story: customer expectations keep rising, call volumes won’t sit still, and human-only call centers are already stretched to the edge. Even in Latin America, AI hype is everywhere—but proven, reliable LatAm AI customer experience stories are harder to find.

This is why we ran our LatAm workshop tour: to sit down with 130 CX leaders from over 130 companies in São Paulo, Bogotá, and Mexico City to talk about one simple idea—how an AI workforce in Latin America can help make every customer interaction count for revenue and relationships, not just call deflection.

Below is an in-depth recap of what we learned together.

Why we hit the road: the real AI gap in LatAm

Across banking/fintech, retail and ecommerce, telco, and BPOs, leaders shared the same challenges:

Labor-heavy voice operations with high attrition and constant hiring pressure: recent global research pegs contact center turnover at 30–45% annually, with some sectors hitting 60%.

Demand spikes they can’t easily staff for: campaigns, due dates, system incidents, seasonal peaks.

A backlog of “AI projects” that looked promising in a demo, but never moved KPIs like recovery rates, NPS, or cost per contact.

LatAm is also a growth hotspot for CX and contact center innovation, with countries like Colombia and Mexico quickly becoming hubs for AI-driven customer operations.

In that context, the big gap we saw wasn’t interest in AI; everyone has that. The gap is between AI curiosity and AI that reliably solves real problems in AI for contact centers in LatAm.

Who we met: 130 leaders, one pattern

Across the three stops, we spoke with CX, collections, sales, and operations leaders from:

Large banks and fintechs managing high-volume collections and servicing

Telcos and ISPs with intense inbound volumes and frequent outages

Retail and ecommerce players fighting to protect loyalty in a price-sensitive market

BPOs and contact centers that live and die by utilization, quality, and SLAs

Their industries and customer bases looked different, but their goals were remarkably similar:

Recover more payments in a respectful, compliant way

Reduce contact center costs with AI without destroying customer trust

Increase sales conversion with AI agents in outbound and cross-sell flows

Deliver “zero wait time customer service” for routine journeys

That’s the lens through which we introduced the idea of an AI workforce for call centers.

What leaders actually want from AI (spoiler: not another chatbot)

Most participants had already tried or inherited some form of automation, such as IVRs, simple bots, and FAQ assistants. The feedback was blunt:

“We don’t need another toy. If we do this again, it has to move collections, churn, or sales. Otherwise, it’s just more complexity.”

Across cities, leaders converged around four requirements for LatAm AI customer experience projects:

Voice-first, not voice-bolted-on

Their most valuable interactions still happen on the phone.

Customers use slang, code-switch between languages, and interrupt often. Any voice AI platform has to be built for that reality, not adapted from text.

Goal-oriented, not chatty

They don’t want bots that talk; they want AI agents that resolve customer issues, secure promises-to-pay, book appointments, and qualify real leads.

Trustworthy by design

Legal, risk, and compliance teams need to know exactly what AI is allowed to say and do, and how it’s measured.

Fit into the stack they already have

No appetite for multi-year replatforming just to test one use case. Any omnichannel conversational AI has to integrate with existing telephony, CRMs, and core systems.

How we framed it: from human-only centers to an AI workforce in Latin America

Rather than leading with “AI agents” or model names, we talked about an AI workforce in Latin America in business terms:

AI workers that handle communication-heavy, repetitive tasks in collections, service, and sales

Humans focusing on complex negotiations, sensitive cases, and high-value relationships

This mirrors what we’ve written already about “virtual employees” and AI agents handling routine work at scale while humans tackle what they do best.

In the workshops, that translated into a clear distinction:

Not “let’s launch a chatbot,” but…

“Let’s give a collections worker a very specific job: reach past-due customers, explain their status, negotiate a payment or plan within guardrails, and confirm the outcome—across voice, SMS, or WhatsApp.”

For many participants, this shift—from channel or technology to job-to-be-done—was the first big unlock.

What we shared: a practical view of AI for contact centers in LatAm

What were the key learnings we were able to share at these CX workshops?

1. Real-world outcomes, not hypothetical ones

We brought anonymized and named examples (where approved) from banking and telco, including:

Collections programs where AI debt collection helped deliver up to 10x better efficiency per dollar spent compared with human-only operations. (Aiphoria)

Service and support deployments achieving up to 80% automation on targeted workflows while cutting response times to zero for many requests.

Sales initiatives where AI workers made new outbound and cross-sell channels economically viable—often at up to 50% lower cost per qualified conversation.

2. A simple mental model: when to use AI workers

We used three questions to identify where AI for customer service and collections in Latin America could most rapidly deliver value and augment human teams:

Is the journey high-volume and repetitive?

Is “success” easy to define and measure (payment, resolution, booking, activation)?

Are the rules and guardrails clear enough to encode?

Whenever the answer was “yes” to all three, the room could usually see a clear case for AI workers where people could absolutely stay in the loop but be freed from repetitive tasks. That way, they could focus their expertise on more complex, high-value work.

Voice-first, or why channels matter less than conversations

A big theme everywhere we visited: voice still dominates the highest-stakes interactions.

Independent research notes that AI-driven contact centers make the biggest experience impact when they let customers use natural language, instead of forcing them through rigid menus.

In LatAm, that means handling:

Fast, overlapping speech

Strong regional accents

Spanish-Portuguese mixes, and sometimes indigenous or local languages across other areas of Central and South America

This is where a voice-first AI platform differs from tools designed for text first:

Low-latency, incremental ASR that begins interpreting speech mid-utterance, enabling natural turn-taking without awkward pauses.

Hyper-realistic TTS that lets you tune tone by use case (firm in collections, reassuring in service, enthusiastic in sales)

Conversation design tied to goals and context, not just keywords

For leaders, the core benefit is simple: if the LatAm AI customer experience feels natural over the phone, it’s far easier to later extend the same logic to chat, apps, and messaging.

Trust and governance: top of mind in São Paulo, Bogotá, and Mexico City

If there was one topic that consistently pulled legal, risk, and IT into the discussion, it was governance.

We heard questions like:

“How do we make sure AI doesn’t say something our regulators would hate?”

“Who owns the AI ‘playbook’—you or us?”

“What happens when fraudsters start using AI voice too?”

Those concerns aren’t theoretical. Synthetic voice fraud is already targeting contact centers, exploiting weak verification and legacy defenses.

In response, we focused on three principles that matter for any enterprise-ready AI platform:

Transparent guardrails

Clear rules about what AI workers can and cannot say or do

Built-in escalation triggers for sensitive cases

End-to-end observability

Every interaction is logged, searchable, and reviewable

Analytics that show business outcomes (recoveries, resolutions, bookings), not just “AI handled X%”

Deployment and data control

Options like private cloud and on-premise deployments

Explicit handling of data residency for regulated industries

For many LatAm leaders, this was the moment AI shifted from “interesting experiment” to something they could imagine presenting to their boards and regulators.

What we heard from the room: patterns across LatAm

By the end of each workshop, the conversations got very specific. A few patterns came up again and again:

Collections leaders wanted to understand how to trial AI for debt collection in LatAm on a limited set of past-due buckets, measure lift, and gradually shift volume.

CX and service leaders gravitated toward “zero wait time customer service” for high-volume requests: account checks, order status, simple changes, FAQs.

Sales and marketing teams were curious about AI for outbound sales, especially in markets where agent costs and lead prices are rising.

BPOs and contact center outsourcers saw potential for an AI workforce layer they could offer to multiple clients while keeping humans focused on premium interactions.

Across roles and cities, the consensus was that AI workforce in Latin America isn’t about replacing humans; it’s about giving them room to breathe, and to focus on the interactions where human judgment really matters. That’s consistent with broader views in the region that AI augments agents, creating “super-agents” rather than eliminating people.

Where should CX leaders start?

If you’re reading this from a LatAm bank, telco, retailer, or BPO (or even from a North American one), the next move doesn’t have to be a massive transformation program.

Here’s a simple starting checklist we shared with attendees that can offer guidance:

Pick 1–2 high-volume journeys

Early-stage collections, appointment rescheduling, card activation, order status—anything simple, repetitive, and measurable.

Define “success” in plain language

e.g., “Increase early-stage recovery by X%,” “Cut wait times from 5–7 minutes to near-zero,” or “Reduce cost per qualified lead by half.”

Map your constraints and guardrails

Compliance rules, escalation triggers, languages and dialects, sensitive customer segments.

Assess your data and stack

What call recordings and outcome data do you already have?

Which systems (telephony, CRM, core platforms) any AI workforce platform would need to talk to?

Run a focused experiment, not a science project

Design a pilot with before/after measurement.

Involve CX, IT, and Risk from day one, so nobody is surprised later.

To sum up…

For many attendees, the tour was their first deep dive into:

Voice-first, goal-oriented AI agents designed as “virtual employees”

Concrete outcomes in AI for banks and fintech (particularly in collections and CX)

The architecture and governance needed to make this sustainable

These were collaborative working sessions that were extremely well-received by attendees. Why? Because they helped CX leaders understand the crucial difference between another “AI experiment” and adopting a truly purpose-built, voice-first AI platform that actually becomes an impactful part of an enterprise’s CX model.

If you’d like to learn how we can help you apply extraordinary voice-first AI to your enterprise’s CX challenges, just try a demo.

Other resources:

Our TBC Uzbekistan case study on AI applications in banking and autonomous collections

Our deep dive on AI in banking customer service and collections

A far-ranging review of AI taking over jobs (virtual employees) and what that really means for human beings

Why banks are “breaking up” with legacy customer-facing tech

Additional resources on AI debt collection and compliance in highly regulated markets

Marketing Team