Trends in Financial Services: Why Banks Are Breaking Up with Legacy Customer-Facing Tech and Not Looking Back

Matteo Ressa

Aug 28, 2025

Bank automation in customer communications didn’t begin with artificial intelligence. It started decades ago with Interactive Voice Response (IVR) systems – those familiar “press 1” menus that forced customers to navigate rigid, scripted paths – often slow, way too complex and frustrating. At the dawn of the digital era those might have done good for both banks and their clients. But today, when customer retention is key to success and people expect real-time seamless connection with their providers, IVRs are rather a burden, than a bridge to resolution.

In 2025, financial institutions are deploying AI-powered Virtual Employees built on large language models (LLMs) in order to meet the demand of their customers. These systems are no longer just scenario based bots – they’re Autonomous Agents capable of holding human-like conversations and independently completing complex tasks. Whether customer-facing or supporting internal teams, these agents work 24/7, never lose context, and adapt in real-time. This shift marks a clear break from traditional automation: we're entering an era where virtual agents take full ownership of outcomes.

This article traces the evolution of automation in banking – from legacy tools that once set the standard to the next-generation systems now reshaping customer communications. We’ll unpack the critical differences between outdated technologies and next-generation solutions – such as AI Copilots, Autonomous Agents, and the Aiphoria Pro Platform itself, which is emerging as the definitive tool driving measurable impact. The goal: to help financial institutions stay ahead of the trends in financial services and lead the way in delivering exceptional customer experiences.

A recent study by Microsoft and LinkedIn found that 75% of global knowledge workers are already using generative AI at work, indicating a growing acceptance of AI tools that augment human capabilities.

Legacy Chatbots – What Went Wrong?

In the early stages of digital transformation, rule-based chatbots played a pivotal role in shaping the first wave of automation in banking. They emerged as practical tools to relieve pressure on call centers and streamline repetitive inquiries – an important milestone in the financial industry at the time. While these systems were well-suited to the market needs of their time, they lacked the contextual awareness and conversational adaptability required to keep pace with the demands of today’s digital-first customers. Understanding their limitations draws a clear line between past inefficiencies and the progress made with today’s AI agents and copilots.

Rule-Based Bots: A Limited, Outdated Solution

These rule-based systems operated through rigid scripts and decision trees, delivering value when customer needs are aligned perfectly with preprogrammed flows. But this is rarely the case now, nor was it back in the days. At the time, bots offered a glimpse into the potential of automated service – a step forward for the banking industry. But as the financial sector evolved, so did customer expectations. Modern users expect flexibility, real-time understanding, and a human touch. Without recent technologies capable of processing and understanding natural language (based on LLMs), legacy technology couldn’t adapt to free-form input, emotional cues, or unexpected scenarios. This contrast highlights the shift from hard-scripted bots to today’s intelligent AI agents – whether deployed as copilots or fully autonomous systems – and reinforces why institutions are embracing these modern, scalable solutions in banking as well as in other industries.

Our research highlights four critical weaknesses that explain why these early systems are being phased out in favor of more intelligent solutions like AI copilots and autonomous agents:

No Real Understanding: Without LLM, legacy bots cannot interpret natural language and deliver off-script responses. And in the end, a person who needs support or attention, has to put in an extra effort to be understood by the machinery, and quite likely – fail.

No Ability to Learn: script-based bots were static. Unlike modern technologies that allow run-time prompt optimization, rule-based bots require manual programming for every scenario – slowing down updating cycles and limiting responsiveness to market shifts. Have you ever felt that any information provided by such a bot seemed outdated? This might be the reason.

Rigid and Difficult to Maintain: While legacy bots can scale to support large customer volumes, attempts to make them more flexible often backfired. As dialogue trees grew more complex, updates became too labor-intensive. Today’s customers expect real-time agility and clear, consistent interactions.

Frustrating User Experiences: Rather than helping customers, legacy chatbots and IVR’s often created friction – forcing users through fixed paths, repeating questions. The result: lower client satisfaction, that defeats the original goal of automation.

The Challenge with Legacy Bots in Banking

As consumers grew accustomed to the seamless, intelligent interactions offered by leading tech and e-commerce platforms, expectations in the banking industry followed suit. Static, scripted bots couldn’t keep up. This is why pioneer banks like TBC Uzbekistan are already moving beyond outdated systems. Rather than patching legacy infrastructure, they are embracing advanced Virtual Agents powered by Conversational AI. These future-ready solutions deliver human-like, context-aware engagement and are purpose-built to meet the expectations of modern digital customers. It’s a strategic shift for institutions committed to leading, not lagging, in the next era of banking.

Conversational AI – Persistent and Adaptive

Today’s Virtual Employees, otherwise known as AI agents, built on Conversational AI technologies, enable banks to engage customers through natural, context-aware dialogue – offering responses that feel more human and intuitive. Beyond just improving service, these systems drive measurable gains in efficiency, scalability, and adapt continuously to changing business needs.

What Is Conversational AI Really?

Conversational AI refers to the set of technologies that enable machines to hold human-like conversations. Powered by modern LLMs paired with ASR (Automatic Speech Recognition) and TTS (Text-To-Speech) models, these systems go far beyond scripted responses. They can interpret intent, retain context throughout an interaction, even if it changes midway, and tailor replies in real time. All this being language agnostic, understanding dialects and so on. This capability unlocks far more fluid conversations – helping banks move past the limitations of traditional chatbots and IVRs toward experiences that feel intuitive, responsive, and genuinely helpful.

3 key strengths that make Virtual Employees/AI agents a compelling solution for financial institutions today:

Cost Efficiency

By automating not only high volumes of routine requests but also more complex customer interactions, conversational AI reduces operational costs and allows human agents to focus on complex, high-value interactions. This results in measurable gains in productivity and staffing flexibility.Scalability

AI agents provide on-demand scalability. Unlike human teams, virtual agents don’t require training, onboarding, or ongoing care—they’re ready to go from day one. Whether you're facing peak-season surges or low-activity periods, AI agents can scale up or down in a matter of hours, not weeks. No sick days, no turnover, no hiring bottlenecks. It's workforce elasticity without the operational burden.

Human-Level Dialogue Quality, Fast and Precise

Thanks to large language models and refined orchestration layers, today’s AI agents can carry out conversations that rival those of human operators. Their ability to understand context, intent, and nuance allows them to provide clear, relevant answers without hesitation. When deployed as copilots, they attentively support human agents by listening to the entire exchange, retrieving data from internal systems, and surfacing next-best actions in real time. This boosts accuracy, shortens response time, and removes the burden of multitasking.

Beyond the Chat Window: Two Key Roles of Conversational AI in Banking

While the conversation around Conversational AI often focuses on fully autonomous agents interacting directly with customers, that's only part of the story. In reality, there are two powerful ways this technology is transforming banking operations.

The first is Autonomous Agent Mode where AI takes the lead, interacting directly with customers through voice or text. These autonomous agents handle entire workflows independently, from resolving support queries to managing transactions, without the need for human intervention.

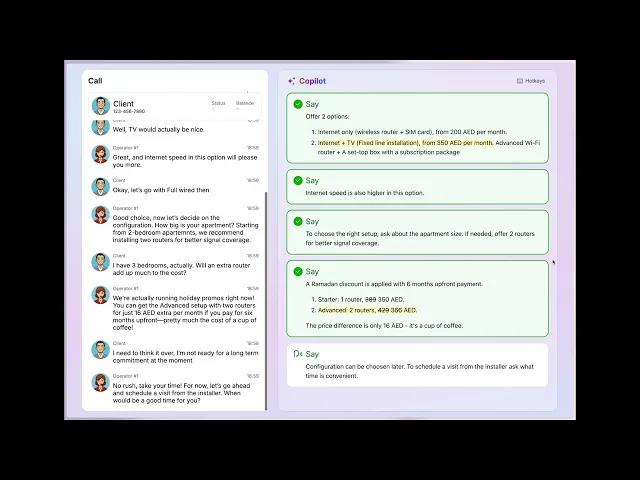

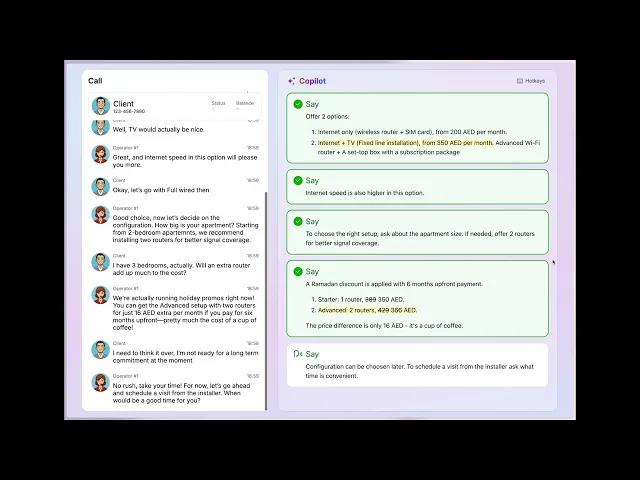

The second is AI Copilot Mode where copilots act as intelligent, behind-the-scenes assistants, mostly operating through text-based interfaces. Rather than engaging customers directly, they support human agents during live interactions by surfacing relevant data, offering personalized suggestions, and summarizing calls while the human agent remains in control.

For example, an AI assistant might prompt a loan officer with next-best actions during a customer consultation or ensure a support agent has all the answers at hand during complex service calls.

Each approach offers distinct advantages depending on the use case. Next, we’ll explore how both models work – and when each is best suited to modern banking needs.

Trends in Financial Services | What are AI Copilots? – Augmenting Human Agents

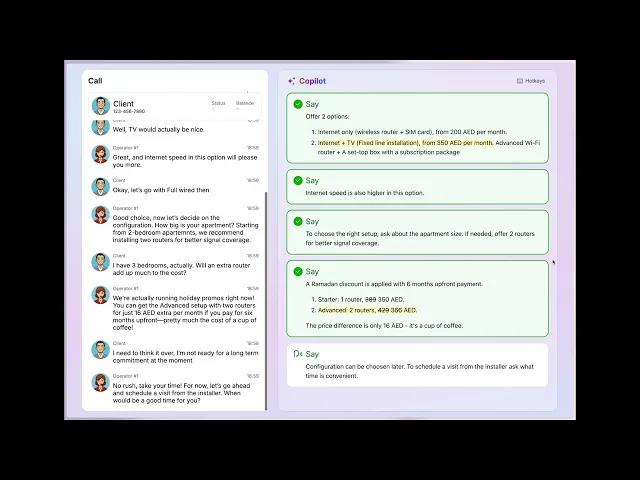

AI copilots operate quietly but powerfully during live customer interactions. They:

Listen to conversations in real time, interpreting both the agent's and the customer's input.

Recognize intent and understand the context of the conversation as it evolves.

Retrieve relevant information from internal systems and data silos instantly.

Suggest responses or next-best actions to help agents stay efficient and accurate.

Offer icebreakers or prompts to guide the tone and direction of and the dialogue when needed.

Help agents maintain a consistent brand tone throughout the call, preventing emotional drift and ensuring professional, controlled communication.

This real-time support enables agents to focus on high-impact human connection – while the copilot handles the complexity under the hood.

The result is a seamless collaboration between human expertise and machine intelligence. From guiding a call center agent through regulatory-compliant scripts to recommending personalized product offers during a live chat, AI copilots boost accuracy, efficiency, speed and service quality—without removing the human touch. Critically, they operate under direct supervision, ensuring that final decisions remain with trained professionals. It’s not about replacing people—it’s about helping them perform at their best.

Real-World Use Cases in Banking

When deployed thoughtfully, AI copilots offer immediate value across frontline banking operations. Here are four practical ways banks are already putting them to work:

Live Script Suggestions

During customer calls or chats, AI copilots offer real-time prompts – helping agents navigate conversations more effectively and maintain consistency in messaging, tone, and service delivery.Compliance Support

Copilots monitor regulatory frameworks in the background, flagging sensitive topics and guiding employees to stay within approved boundaries – reducing compliance risk without slowing the interaction.CRM and Workflow Automation

Instead of manually updating customer profiles or logging interactions, AI copilots handle administrative tasks automatically – freeing employees to focus on relationship-building and decision-making.Instant Document Retrieval

Whether it's a loan policy, transaction history, or internal knowledge base article, copilots quickly surface relevant documents – cutting down time spent searching and improving first-contact resolution rates. According to Capgemini, banks could optimize up to 66% of the time spent on operations, documentation, compliance, and other onboarding-related activities through AI-powered intelligent transformation and generative AI copilots.

Copilots and Autonomous Agents: The Best of Both Worlds

Copilots and autonomous agents play complementary roles within a unified AI strategy. Autonomous agents are ideal for managing high volumes of routine and moderately complex interactions – delivering consistent, 24/7 service at scale. Copilots, meanwhile, provide real-time support to human agents during more nuanced or high-context conversations – where live judgment, empathy, or personalization elevate the experience. Rather than acting as a fallback, copilots are being used strategically to enhance human performance in moments that matter most. This approach enables banks to combine the power of full automation with intelligent human collaboration – deploying the right capabilities for the right moments across the customer journey.

Trends in Financial Services | What are Autonomous AI Agents? – Fully Independent Virtual Employees

In contrast to AI copilots autonomous AI agents function independently, without the need for human manual oversight. These systems can initiate actions, make decisions, and complete end-to-end tasks in real time, making them a transformative force in the financial services customer relations.

Real-World Use Cases in Banking

Notable applications of Autonomous AI Agents include:

AI-Powered Debt Collection

AI agents manage early-stage collections with persistence and precision – initiating outbound calls, negotiating promises to pay, and reducing operational costs without compromising customer experience.

Read more: AI Debt Collection – How Conversational AI Supercharged Efficiency and Scalability

Sales Tasks

AI agents are redefining banking sales by handling both inbound and outbound activities with speed and precision. Whether it's qualifying incoming leads, following up on abandoned applications, or even initiating proactive outreach like cold calling.

Read more: AI in Financial Services: How Conversational AI is Revolutionizing Banking Sales

24/7 Customer Service

Autonomous agents independently resolve high-volume support requests – checking balances, updating account preferences, or handling KYC processes – delivering consistent, always-on service without escalation.

These implementations not only improve operational efficiency but also directly impact customer retention, proving that reducing service effort leads to dramatically higher loyalty. In line with the latest trends in finance, automation and personalization aren't just efficiencies, they're loyalty drivers.

High Potential, Expertly Delivered

Deploying autonomous AI agents in banking doesn’t have to be daunting – but it does require the right approach. These systems unlock powerful opportunities to automate complex processes, drive operational efficiency, and elevate customer experiences. Naturally, introducing AI into regulated environments comes with specific considerations – from ensuring compliance to managing change and integrating with legacy systems.

That’s where the right partner makes all the difference. As McKinsey points out, scaling AI in banking requires both the right technology and the right execution. We bring both – so your team doesn’t have to choose between innovation and control.

Aiphoria Pro Platform as a Reliable Example

At Aiphoria, we specialize in helping financial institutions deploy AI agents, copilots and autonomous ones, responsibly and at scale. Aiphoria Pro Platform is built with banking-grade reliability, and our team brings deep expertise in navigating regulatory frameworks, minimizing operational risk, and accelerating adoption.

What sets the Aiphoria Pro Platform apart are its three core pillars:

On-premise deployment options for institutions with strict data residency or security requirements,

A modular architecture that allows banks to scale capabilities gradually based on their needs,

And goal-oriented AI scenarios tailored to specific business outcomes such as obtaining the promise to pay, process incoming sales requests, or simply picking up the phone right away.

Whether assisting human agents in co-pilot mode or operating independently as fully autonomous AI agents, Aiphoria Pros dramatically improve efficiency across customer support, mass recruitment, payment reminders and sales. Available across multiple support channels, the platform enables banks to scale without increasing headcount – while maintaining compliance, consistency, and 24/7 availability.

Conclusion

As McKinsey pointed out, banks that embed AI across the customer journey are significantly more likely to see gains in both revenue and customer retention. The future of AI in banking is bright – and it will be shaped by institutions willing to lead. Whether through AI copilots supporting internal teams or autonomous agents engaging customers directly, those who act now will set the standard for the next era of digital banking. At Aiphhoria, we are here to help make that transition a success. Aiphoria Pro Platform is built for cases relevant to the banking industry. It supports complex dialogue flows, integrates seamlessly with core systems, and aligns with strict regulatory and compliance standards. With multilingual capabilities and flexible deployment options Aiphoria ensures conversational AI not only automates and helps cut operational costs, but elevates the experience for the banking customers of the future.

Ready to transform your banking operations with AI? Book a demo

Other Sources:

Anton Shestakov

Trends in Financial Services: Why Banks Are Breaking Up with Legacy Customer-Facing Tech and Not Looking Back

Matteo Ressa

Aug 28, 2025

Bank automation in customer communications didn’t begin with artificial intelligence. It started decades ago with Interactive Voice Response (IVR) systems – those familiar “press 1” menus that forced customers to navigate rigid, scripted paths – often slow, way too complex and frustrating. At the dawn of the digital era those might have done good for both banks and their clients. But today, when customer retention is key to success and people expect real-time seamless connection with their providers, IVRs are rather a burden, than a bridge to resolution.

In 2025, financial institutions are deploying AI-powered Virtual Employees built on large language models (LLMs) in order to meet the demand of their customers. These systems are no longer just scenario based bots – they’re Autonomous Agents capable of holding human-like conversations and independently completing complex tasks. Whether customer-facing or supporting internal teams, these agents work 24/7, never lose context, and adapt in real-time. This shift marks a clear break from traditional automation: we're entering an era where virtual agents take full ownership of outcomes.

This article traces the evolution of automation in banking – from legacy tools that once set the standard to the next-generation systems now reshaping customer communications. We’ll unpack the critical differences between outdated technologies and next-generation solutions – such as AI Copilots, Autonomous Agents, and the Aiphoria Pro Platform itself, which is emerging as the definitive tool driving measurable impact. The goal: to help financial institutions stay ahead of the trends in financial services and lead the way in delivering exceptional customer experiences.

A recent study by Microsoft and LinkedIn found that 75% of global knowledge workers are already using generative AI at work, indicating a growing acceptance of AI tools that augment human capabilities.

Legacy Chatbots – What Went Wrong?

In the early stages of digital transformation, rule-based chatbots played a pivotal role in shaping the first wave of automation in banking. They emerged as practical tools to relieve pressure on call centers and streamline repetitive inquiries – an important milestone in the financial industry at the time. While these systems were well-suited to the market needs of their time, they lacked the contextual awareness and conversational adaptability required to keep pace with the demands of today’s digital-first customers. Understanding their limitations draws a clear line between past inefficiencies and the progress made with today’s AI agents and copilots.

Rule-Based Bots: A Limited, Outdated Solution

These rule-based systems operated through rigid scripts and decision trees, delivering value when customer needs are aligned perfectly with preprogrammed flows. But this is rarely the case now, nor was it back in the days. At the time, bots offered a glimpse into the potential of automated service – a step forward for the banking industry. But as the financial sector evolved, so did customer expectations. Modern users expect flexibility, real-time understanding, and a human touch. Without recent technologies capable of processing and understanding natural language (based on LLMs), legacy technology couldn’t adapt to free-form input, emotional cues, or unexpected scenarios. This contrast highlights the shift from hard-scripted bots to today’s intelligent AI agents – whether deployed as copilots or fully autonomous systems – and reinforces why institutions are embracing these modern, scalable solutions in banking as well as in other industries.

Our research highlights four critical weaknesses that explain why these early systems are being phased out in favor of more intelligent solutions like AI copilots and autonomous agents:

No Real Understanding: Without LLM, legacy bots cannot interpret natural language and deliver off-script responses. And in the end, a person who needs support or attention, has to put in an extra effort to be understood by the machinery, and quite likely – fail.

No Ability to Learn: script-based bots were static. Unlike modern technologies that allow run-time prompt optimization, rule-based bots require manual programming for every scenario – slowing down updating cycles and limiting responsiveness to market shifts. Have you ever felt that any information provided by such a bot seemed outdated? This might be the reason.

Rigid and Difficult to Maintain: While legacy bots can scale to support large customer volumes, attempts to make them more flexible often backfired. As dialogue trees grew more complex, updates became too labor-intensive. Today’s customers expect real-time agility and clear, consistent interactions.

Frustrating User Experiences: Rather than helping customers, legacy chatbots and IVR’s often created friction – forcing users through fixed paths, repeating questions. The result: lower client satisfaction, that defeats the original goal of automation.

The Challenge with Legacy Bots in Banking

As consumers grew accustomed to the seamless, intelligent interactions offered by leading tech and e-commerce platforms, expectations in the banking industry followed suit. Static, scripted bots couldn’t keep up. This is why pioneer banks like TBC Uzbekistan are already moving beyond outdated systems. Rather than patching legacy infrastructure, they are embracing advanced Virtual Agents powered by Conversational AI. These future-ready solutions deliver human-like, context-aware engagement and are purpose-built to meet the expectations of modern digital customers. It’s a strategic shift for institutions committed to leading, not lagging, in the next era of banking.

Conversational AI – Persistent and Adaptive

Today’s Virtual Employees, otherwise known as AI agents, built on Conversational AI technologies, enable banks to engage customers through natural, context-aware dialogue – offering responses that feel more human and intuitive. Beyond just improving service, these systems drive measurable gains in efficiency, scalability, and adapt continuously to changing business needs.

What Is Conversational AI Really?

Conversational AI refers to the set of technologies that enable machines to hold human-like conversations. Powered by modern LLMs paired with ASR (Automatic Speech Recognition) and TTS (Text-To-Speech) models, these systems go far beyond scripted responses. They can interpret intent, retain context throughout an interaction, even if it changes midway, and tailor replies in real time. All this being language agnostic, understanding dialects and so on. This capability unlocks far more fluid conversations – helping banks move past the limitations of traditional chatbots and IVRs toward experiences that feel intuitive, responsive, and genuinely helpful.

3 key strengths that make Virtual Employees/AI agents a compelling solution for financial institutions today:

Cost Efficiency

By automating not only high volumes of routine requests but also more complex customer interactions, conversational AI reduces operational costs and allows human agents to focus on complex, high-value interactions. This results in measurable gains in productivity and staffing flexibility.Scalability

AI agents provide on-demand scalability. Unlike human teams, virtual agents don’t require training, onboarding, or ongoing care—they’re ready to go from day one. Whether you're facing peak-season surges or low-activity periods, AI agents can scale up or down in a matter of hours, not weeks. No sick days, no turnover, no hiring bottlenecks. It's workforce elasticity without the operational burden.

Human-Level Dialogue Quality, Fast and Precise

Thanks to large language models and refined orchestration layers, today’s AI agents can carry out conversations that rival those of human operators. Their ability to understand context, intent, and nuance allows them to provide clear, relevant answers without hesitation. When deployed as copilots, they attentively support human agents by listening to the entire exchange, retrieving data from internal systems, and surfacing next-best actions in real time. This boosts accuracy, shortens response time, and removes the burden of multitasking.

Beyond the Chat Window: Two Key Roles of Conversational AI in Banking

While the conversation around Conversational AI often focuses on fully autonomous agents interacting directly with customers, that's only part of the story. In reality, there are two powerful ways this technology is transforming banking operations.

The first is Autonomous Agent Mode where AI takes the lead, interacting directly with customers through voice or text. These autonomous agents handle entire workflows independently, from resolving support queries to managing transactions, without the need for human intervention.

The second is AI Copilot Mode where copilots act as intelligent, behind-the-scenes assistants, mostly operating through text-based interfaces. Rather than engaging customers directly, they support human agents during live interactions by surfacing relevant data, offering personalized suggestions, and summarizing calls while the human agent remains in control.

For example, an AI assistant might prompt a loan officer with next-best actions during a customer consultation or ensure a support agent has all the answers at hand during complex service calls.

Each approach offers distinct advantages depending on the use case. Next, we’ll explore how both models work – and when each is best suited to modern banking needs.

Trends in Financial Services | What are AI Copilots? – Augmenting Human Agents

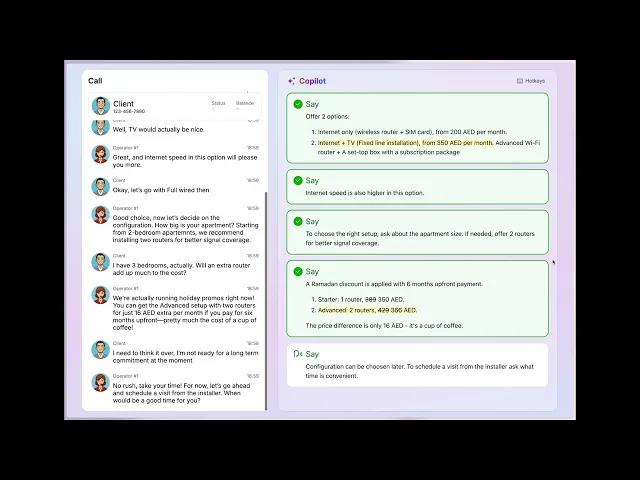

AI copilots operate quietly but powerfully during live customer interactions. They:

Listen to conversations in real time, interpreting both the agent's and the customer's input.

Recognize intent and understand the context of the conversation as it evolves.

Retrieve relevant information from internal systems and data silos instantly.

Suggest responses or next-best actions to help agents stay efficient and accurate.

Offer icebreakers or prompts to guide the tone and direction of and the dialogue when needed.

Help agents maintain a consistent brand tone throughout the call, preventing emotional drift and ensuring professional, controlled communication.

This real-time support enables agents to focus on high-impact human connection – while the copilot handles the complexity under the hood.

The result is a seamless collaboration between human expertise and machine intelligence. From guiding a call center agent through regulatory-compliant scripts to recommending personalized product offers during a live chat, AI copilots boost accuracy, efficiency, speed and service quality—without removing the human touch. Critically, they operate under direct supervision, ensuring that final decisions remain with trained professionals. It’s not about replacing people—it’s about helping them perform at their best.

Real-World Use Cases in Banking

When deployed thoughtfully, AI copilots offer immediate value across frontline banking operations. Here are four practical ways banks are already putting them to work:

Live Script Suggestions

During customer calls or chats, AI copilots offer real-time prompts – helping agents navigate conversations more effectively and maintain consistency in messaging, tone, and service delivery.Compliance Support

Copilots monitor regulatory frameworks in the background, flagging sensitive topics and guiding employees to stay within approved boundaries – reducing compliance risk without slowing the interaction.CRM and Workflow Automation

Instead of manually updating customer profiles or logging interactions, AI copilots handle administrative tasks automatically – freeing employees to focus on relationship-building and decision-making.Instant Document Retrieval

Whether it's a loan policy, transaction history, or internal knowledge base article, copilots quickly surface relevant documents – cutting down time spent searching and improving first-contact resolution rates. According to Capgemini, banks could optimize up to 66% of the time spent on operations, documentation, compliance, and other onboarding-related activities through AI-powered intelligent transformation and generative AI copilots.

Copilots and Autonomous Agents: The Best of Both Worlds

Copilots and autonomous agents play complementary roles within a unified AI strategy. Autonomous agents are ideal for managing high volumes of routine and moderately complex interactions – delivering consistent, 24/7 service at scale. Copilots, meanwhile, provide real-time support to human agents during more nuanced or high-context conversations – where live judgment, empathy, or personalization elevate the experience. Rather than acting as a fallback, copilots are being used strategically to enhance human performance in moments that matter most. This approach enables banks to combine the power of full automation with intelligent human collaboration – deploying the right capabilities for the right moments across the customer journey.

Trends in Financial Services | What are Autonomous AI Agents? – Fully Independent Virtual Employees

In contrast to AI copilots autonomous AI agents function independently, without the need for human manual oversight. These systems can initiate actions, make decisions, and complete end-to-end tasks in real time, making them a transformative force in the financial services customer relations.

Real-World Use Cases in Banking

Notable applications of Autonomous AI Agents include:

AI-Powered Debt Collection

AI agents manage early-stage collections with persistence and precision – initiating outbound calls, negotiating promises to pay, and reducing operational costs without compromising customer experience.

Read more: AI Debt Collection – How Conversational AI Supercharged Efficiency and Scalability

Sales Tasks

AI agents are redefining banking sales by handling both inbound and outbound activities with speed and precision. Whether it's qualifying incoming leads, following up on abandoned applications, or even initiating proactive outreach like cold calling.

Read more: AI in Financial Services: How Conversational AI is Revolutionizing Banking Sales

24/7 Customer Service

Autonomous agents independently resolve high-volume support requests – checking balances, updating account preferences, or handling KYC processes – delivering consistent, always-on service without escalation.

These implementations not only improve operational efficiency but also directly impact customer retention, proving that reducing service effort leads to dramatically higher loyalty. In line with the latest trends in finance, automation and personalization aren't just efficiencies, they're loyalty drivers.

High Potential, Expertly Delivered

Deploying autonomous AI agents in banking doesn’t have to be daunting – but it does require the right approach. These systems unlock powerful opportunities to automate complex processes, drive operational efficiency, and elevate customer experiences. Naturally, introducing AI into regulated environments comes with specific considerations – from ensuring compliance to managing change and integrating with legacy systems.

That’s where the right partner makes all the difference. As McKinsey points out, scaling AI in banking requires both the right technology and the right execution. We bring both – so your team doesn’t have to choose between innovation and control.

Aiphoria Pro Platform as a Reliable Example

At Aiphoria, we specialize in helping financial institutions deploy AI agents, copilots and autonomous ones, responsibly and at scale. Aiphoria Pro Platform is built with banking-grade reliability, and our team brings deep expertise in navigating regulatory frameworks, minimizing operational risk, and accelerating adoption.

What sets the Aiphoria Pro Platform apart are its three core pillars:

On-premise deployment options for institutions with strict data residency or security requirements,

A modular architecture that allows banks to scale capabilities gradually based on their needs,

And goal-oriented AI scenarios tailored to specific business outcomes such as obtaining the promise to pay, process incoming sales requests, or simply picking up the phone right away.

Whether assisting human agents in co-pilot mode or operating independently as fully autonomous AI agents, Aiphoria Pros dramatically improve efficiency across customer support, mass recruitment, payment reminders and sales. Available across multiple support channels, the platform enables banks to scale without increasing headcount – while maintaining compliance, consistency, and 24/7 availability.

Conclusion

As McKinsey pointed out, banks that embed AI across the customer journey are significantly more likely to see gains in both revenue and customer retention. The future of AI in banking is bright – and it will be shaped by institutions willing to lead. Whether through AI copilots supporting internal teams or autonomous agents engaging customers directly, those who act now will set the standard for the next era of digital banking. At Aiphhoria, we are here to help make that transition a success. Aiphoria Pro Platform is built for cases relevant to the banking industry. It supports complex dialogue flows, integrates seamlessly with core systems, and aligns with strict regulatory and compliance standards. With multilingual capabilities and flexible deployment options Aiphoria ensures conversational AI not only automates and helps cut operational costs, but elevates the experience for the banking customers of the future.

Ready to transform your banking operations with AI? Book a demo

Other Sources:

Anton Shestakov

Trends in Financial Services: Why Banks Are Breaking Up with Legacy Customer-Facing Tech and Not Looking Back

Trends in Financial Services: Why Banks Are Breaking Up with Legacy Customer-Facing Tech and Not Looking Back

Matteo Ressa

Aug 28, 2025

Bank automation in customer communications didn’t begin with artificial intelligence. It started decades ago with Interactive Voice Response (IVR) systems – those familiar “press 1” menus that forced customers to navigate rigid, scripted paths – often slow, way too complex and frustrating. At the dawn of the digital era those might have done good for both banks and their clients. But today, when customer retention is key to success and people expect real-time seamless connection with their providers, IVRs are rather a burden, than a bridge to resolution.

In 2025, financial institutions are deploying AI-powered Virtual Employees built on large language models (LLMs) in order to meet the demand of their customers. These systems are no longer just scenario based bots – they’re Autonomous Agents capable of holding human-like conversations and independently completing complex tasks. Whether customer-facing or supporting internal teams, these agents work 24/7, never lose context, and adapt in real-time. This shift marks a clear break from traditional automation: we're entering an era where virtual agents take full ownership of outcomes.

This article traces the evolution of automation in banking – from legacy tools that once set the standard to the next-generation systems now reshaping customer communications. We’ll unpack the critical differences between outdated technologies and next-generation solutions – such as AI Copilots, Autonomous Agents, and the Aiphoria Pro Platform itself, which is emerging as the definitive tool driving measurable impact. The goal: to help financial institutions stay ahead of the trends in financial services and lead the way in delivering exceptional customer experiences.

A recent study by Microsoft and LinkedIn found that 75% of global knowledge workers are already using generative AI at work, indicating a growing acceptance of AI tools that augment human capabilities.

Legacy Chatbots – What Went Wrong?

In the early stages of digital transformation, rule-based chatbots played a pivotal role in shaping the first wave of automation in banking. They emerged as practical tools to relieve pressure on call centers and streamline repetitive inquiries – an important milestone in the financial industry at the time. While these systems were well-suited to the market needs of their time, they lacked the contextual awareness and conversational adaptability required to keep pace with the demands of today’s digital-first customers. Understanding their limitations draws a clear line between past inefficiencies and the progress made with today’s AI agents and copilots.

Rule-Based Bots: A Limited, Outdated Solution

These rule-based systems operated through rigid scripts and decision trees, delivering value when customer needs are aligned perfectly with preprogrammed flows. But this is rarely the case now, nor was it back in the days. At the time, bots offered a glimpse into the potential of automated service – a step forward for the banking industry. But as the financial sector evolved, so did customer expectations. Modern users expect flexibility, real-time understanding, and a human touch. Without recent technologies capable of processing and understanding natural language (based on LLMs), legacy technology couldn’t adapt to free-form input, emotional cues, or unexpected scenarios. This contrast highlights the shift from hard-scripted bots to today’s intelligent AI agents – whether deployed as copilots or fully autonomous systems – and reinforces why institutions are embracing these modern, scalable solutions in banking as well as in other industries.

Our research highlights four critical weaknesses that explain why these early systems are being phased out in favor of more intelligent solutions like AI copilots and autonomous agents:

No Real Understanding: Without LLM, legacy bots cannot interpret natural language and deliver off-script responses. And in the end, a person who needs support or attention, has to put in an extra effort to be understood by the machinery, and quite likely – fail.

No Ability to Learn: script-based bots were static. Unlike modern technologies that allow run-time prompt optimization, rule-based bots require manual programming for every scenario – slowing down updating cycles and limiting responsiveness to market shifts. Have you ever felt that any information provided by such a bot seemed outdated? This might be the reason.

Rigid and Difficult to Maintain: While legacy bots can scale to support large customer volumes, attempts to make them more flexible often backfired. As dialogue trees grew more complex, updates became too labor-intensive. Today’s customers expect real-time agility and clear, consistent interactions.

Frustrating User Experiences: Rather than helping customers, legacy chatbots and IVR’s often created friction – forcing users through fixed paths, repeating questions. The result: lower client satisfaction, that defeats the original goal of automation.

The Challenge with Legacy Bots in Banking

As consumers grew accustomed to the seamless, intelligent interactions offered by leading tech and e-commerce platforms, expectations in the banking industry followed suit. Static, scripted bots couldn’t keep up. This is why pioneer banks like TBC Uzbekistan are already moving beyond outdated systems. Rather than patching legacy infrastructure, they are embracing advanced Virtual Agents powered by Conversational AI. These future-ready solutions deliver human-like, context-aware engagement and are purpose-built to meet the expectations of modern digital customers. It’s a strategic shift for institutions committed to leading, not lagging, in the next era of banking.

Conversational AI – Persistent and Adaptive

Today’s Virtual Employees, otherwise known as AI agents, built on Conversational AI technologies, enable banks to engage customers through natural, context-aware dialogue – offering responses that feel more human and intuitive. Beyond just improving service, these systems drive measurable gains in efficiency, scalability, and adapt continuously to changing business needs.

What Is Conversational AI Really?

Conversational AI refers to the set of technologies that enable machines to hold human-like conversations. Powered by modern LLMs paired with ASR (Automatic Speech Recognition) and TTS (Text-To-Speech) models, these systems go far beyond scripted responses. They can interpret intent, retain context throughout an interaction, even if it changes midway, and tailor replies in real time. All this being language agnostic, understanding dialects and so on. This capability unlocks far more fluid conversations – helping banks move past the limitations of traditional chatbots and IVRs toward experiences that feel intuitive, responsive, and genuinely helpful.

3 key strengths that make Virtual Employees/AI agents a compelling solution for financial institutions today:

Cost Efficiency

By automating not only high volumes of routine requests but also more complex customer interactions, conversational AI reduces operational costs and allows human agents to focus on complex, high-value interactions. This results in measurable gains in productivity and staffing flexibility.Scalability

AI agents provide on-demand scalability. Unlike human teams, virtual agents don’t require training, onboarding, or ongoing care—they’re ready to go from day one. Whether you're facing peak-season surges or low-activity periods, AI agents can scale up or down in a matter of hours, not weeks. No sick days, no turnover, no hiring bottlenecks. It's workforce elasticity without the operational burden.

Human-Level Dialogue Quality, Fast and Precise

Thanks to large language models and refined orchestration layers, today’s AI agents can carry out conversations that rival those of human operators. Their ability to understand context, intent, and nuance allows them to provide clear, relevant answers without hesitation. When deployed as copilots, they attentively support human agents by listening to the entire exchange, retrieving data from internal systems, and surfacing next-best actions in real time. This boosts accuracy, shortens response time, and removes the burden of multitasking.

Beyond the Chat Window: Two Key Roles of Conversational AI in Banking

While the conversation around Conversational AI often focuses on fully autonomous agents interacting directly with customers, that's only part of the story. In reality, there are two powerful ways this technology is transforming banking operations.

The first is Autonomous Agent Mode where AI takes the lead, interacting directly with customers through voice or text. These autonomous agents handle entire workflows independently, from resolving support queries to managing transactions, without the need for human intervention.

The second is AI Copilot Mode where copilots act as intelligent, behind-the-scenes assistants, mostly operating through text-based interfaces. Rather than engaging customers directly, they support human agents during live interactions by surfacing relevant data, offering personalized suggestions, and summarizing calls while the human agent remains in control.

For example, an AI assistant might prompt a loan officer with next-best actions during a customer consultation or ensure a support agent has all the answers at hand during complex service calls.

Each approach offers distinct advantages depending on the use case. Next, we’ll explore how both models work – and when each is best suited to modern banking needs.

Trends in Financial Services | What are AI Copilots? – Augmenting Human Agents

AI copilots operate quietly but powerfully during live customer interactions. They:

Listen to conversations in real time, interpreting both the agent's and the customer's input.

Recognize intent and understand the context of the conversation as it evolves.

Retrieve relevant information from internal systems and data silos instantly.

Suggest responses or next-best actions to help agents stay efficient and accurate.

Offer icebreakers or prompts to guide the tone and direction of and the dialogue when needed.

Help agents maintain a consistent brand tone throughout the call, preventing emotional drift and ensuring professional, controlled communication.

This real-time support enables agents to focus on high-impact human connection – while the copilot handles the complexity under the hood.

The result is a seamless collaboration between human expertise and machine intelligence. From guiding a call center agent through regulatory-compliant scripts to recommending personalized product offers during a live chat, AI copilots boost accuracy, efficiency, speed and service quality—without removing the human touch. Critically, they operate under direct supervision, ensuring that final decisions remain with trained professionals. It’s not about replacing people—it’s about helping them perform at their best.

Real-World Use Cases in Banking

When deployed thoughtfully, AI copilots offer immediate value across frontline banking operations. Here are four practical ways banks are already putting them to work:

Live Script Suggestions

During customer calls or chats, AI copilots offer real-time prompts – helping agents navigate conversations more effectively and maintain consistency in messaging, tone, and service delivery.Compliance Support

Copilots monitor regulatory frameworks in the background, flagging sensitive topics and guiding employees to stay within approved boundaries – reducing compliance risk without slowing the interaction.CRM and Workflow Automation

Instead of manually updating customer profiles or logging interactions, AI copilots handle administrative tasks automatically – freeing employees to focus on relationship-building and decision-making.Instant Document Retrieval

Whether it's a loan policy, transaction history, or internal knowledge base article, copilots quickly surface relevant documents – cutting down time spent searching and improving first-contact resolution rates. According to Capgemini, banks could optimize up to 66% of the time spent on operations, documentation, compliance, and other onboarding-related activities through AI-powered intelligent transformation and generative AI copilots.

Copilots and Autonomous Agents: The Best of Both Worlds

Copilots and autonomous agents play complementary roles within a unified AI strategy. Autonomous agents are ideal for managing high volumes of routine and moderately complex interactions – delivering consistent, 24/7 service at scale. Copilots, meanwhile, provide real-time support to human agents during more nuanced or high-context conversations – where live judgment, empathy, or personalization elevate the experience. Rather than acting as a fallback, copilots are being used strategically to enhance human performance in moments that matter most. This approach enables banks to combine the power of full automation with intelligent human collaboration – deploying the right capabilities for the right moments across the customer journey.

Trends in Financial Services | What are Autonomous AI Agents? – Fully Independent Virtual Employees

In contrast to AI copilots autonomous AI agents function independently, without the need for human manual oversight. These systems can initiate actions, make decisions, and complete end-to-end tasks in real time, making them a transformative force in the financial services customer relations.

Real-World Use Cases in Banking

Notable applications of Autonomous AI Agents include:

AI-Powered Debt Collection

AI agents manage early-stage collections with persistence and precision – initiating outbound calls, negotiating promises to pay, and reducing operational costs without compromising customer experience.

Read more: AI Debt Collection – How Conversational AI Supercharged Efficiency and Scalability

Sales Tasks

AI agents are redefining banking sales by handling both inbound and outbound activities with speed and precision. Whether it's qualifying incoming leads, following up on abandoned applications, or even initiating proactive outreach like cold calling.

Read more: AI in Financial Services: How Conversational AI is Revolutionizing Banking Sales

24/7 Customer Service

Autonomous agents independently resolve high-volume support requests – checking balances, updating account preferences, or handling KYC processes – delivering consistent, always-on service without escalation.

These implementations not only improve operational efficiency but also directly impact customer retention, proving that reducing service effort leads to dramatically higher loyalty. In line with the latest trends in finance, automation and personalization aren't just efficiencies, they're loyalty drivers.

High Potential, Expertly Delivered

Deploying autonomous AI agents in banking doesn’t have to be daunting – but it does require the right approach. These systems unlock powerful opportunities to automate complex processes, drive operational efficiency, and elevate customer experiences. Naturally, introducing AI into regulated environments comes with specific considerations – from ensuring compliance to managing change and integrating with legacy systems.

That’s where the right partner makes all the difference. As McKinsey points out, scaling AI in banking requires both the right technology and the right execution. We bring both – so your team doesn’t have to choose between innovation and control.

Aiphoria Pro Platform as a Reliable Example

At Aiphoria, we specialize in helping financial institutions deploy AI agents, copilots and autonomous ones, responsibly and at scale. Aiphoria Pro Platform is built with banking-grade reliability, and our team brings deep expertise in navigating regulatory frameworks, minimizing operational risk, and accelerating adoption.

What sets the Aiphoria Pro Platform apart are its three core pillars:

On-premise deployment options for institutions with strict data residency or security requirements,

A modular architecture that allows banks to scale capabilities gradually based on their needs,

And goal-oriented AI scenarios tailored to specific business outcomes such as obtaining the promise to pay, process incoming sales requests, or simply picking up the phone right away.

Whether assisting human agents in co-pilot mode or operating independently as fully autonomous AI agents, Aiphoria Pros dramatically improve efficiency across customer support, mass recruitment, payment reminders and sales. Available across multiple support channels, the platform enables banks to scale without increasing headcount – while maintaining compliance, consistency, and 24/7 availability.

Conclusion

As McKinsey pointed out, banks that embed AI across the customer journey are significantly more likely to see gains in both revenue and customer retention. The future of AI in banking is bright – and it will be shaped by institutions willing to lead. Whether through AI copilots supporting internal teams or autonomous agents engaging customers directly, those who act now will set the standard for the next era of digital banking. At Aiphhoria, we are here to help make that transition a success. Aiphoria Pro Platform is built for cases relevant to the banking industry. It supports complex dialogue flows, integrates seamlessly with core systems, and aligns with strict regulatory and compliance standards. With multilingual capabilities and flexible deployment options Aiphoria ensures conversational AI not only automates and helps cut operational costs, but elevates the experience for the banking customers of the future.

Ready to transform your banking operations with AI? Book a demo

Other Sources:

Bank automation in customer communications didn’t begin with artificial intelligence. It started decades ago with Interactive Voice Response (IVR) systems – those familiar “press 1” menus that forced customers to navigate rigid, scripted paths – often slow, way too complex and frustrating. At the dawn of the digital era those might have done good for both banks and their clients. But today, when customer retention is key to success and people expect real-time seamless connection with their providers, IVRs are rather a burden, than a bridge to resolution.

In 2025, financial institutions are deploying AI-powered Virtual Employees built on large language models (LLMs) in order to meet the demand of their customers. These systems are no longer just scenario based bots – they’re Autonomous Agents capable of holding human-like conversations and independently completing complex tasks. Whether customer-facing or supporting internal teams, these agents work 24/7, never lose context, and adapt in real-time. This shift marks a clear break from traditional automation: we're entering an era where virtual agents take full ownership of outcomes.

This article traces the evolution of automation in banking – from legacy tools that once set the standard to the next-generation systems now reshaping customer communications. We’ll unpack the critical differences between outdated technologies and next-generation solutions – such as AI Copilots, Autonomous Agents, and the Aiphoria Pro Platform itself, which is emerging as the definitive tool driving measurable impact. The goal: to help financial institutions stay ahead of the trends in financial services and lead the way in delivering exceptional customer experiences.

A recent study by Microsoft and LinkedIn found that 75% of global knowledge workers are already using generative AI at work, indicating a growing acceptance of AI tools that augment human capabilities.

Legacy Chatbots – What Went Wrong?

In the early stages of digital transformation, rule-based chatbots played a pivotal role in shaping the first wave of automation in banking. They emerged as practical tools to relieve pressure on call centers and streamline repetitive inquiries – an important milestone in the financial industry at the time. While these systems were well-suited to the market needs of their time, they lacked the contextual awareness and conversational adaptability required to keep pace with the demands of today’s digital-first customers. Understanding their limitations draws a clear line between past inefficiencies and the progress made with today’s AI agents and copilots.

Rule-Based Bots: A Limited, Outdated Solution

These rule-based systems operated through rigid scripts and decision trees, delivering value when customer needs are aligned perfectly with preprogrammed flows. But this is rarely the case now, nor was it back in the days. At the time, bots offered a glimpse into the potential of automated service – a step forward for the banking industry. But as the financial sector evolved, so did customer expectations. Modern users expect flexibility, real-time understanding, and a human touch. Without recent technologies capable of processing and understanding natural language (based on LLMs), legacy technology couldn’t adapt to free-form input, emotional cues, or unexpected scenarios. This contrast highlights the shift from hard-scripted bots to today’s intelligent AI agents – whether deployed as copilots or fully autonomous systems – and reinforces why institutions are embracing these modern, scalable solutions in banking as well as in other industries.

Our research highlights four critical weaknesses that explain why these early systems are being phased out in favor of more intelligent solutions like AI copilots and autonomous agents:

No Real Understanding: Without LLM, legacy bots cannot interpret natural language and deliver off-script responses. And in the end, a person who needs support or attention, has to put in an extra effort to be understood by the machinery, and quite likely – fail.

No Ability to Learn: script-based bots were static. Unlike modern technologies that allow run-time prompt optimization, rule-based bots require manual programming for every scenario – slowing down updating cycles and limiting responsiveness to market shifts. Have you ever felt that any information provided by such a bot seemed outdated? This might be the reason.

Rigid and Difficult to Maintain: While legacy bots can scale to support large customer volumes, attempts to make them more flexible often backfired. As dialogue trees grew more complex, updates became too labor-intensive. Today’s customers expect real-time agility and clear, consistent interactions.

Frustrating User Experiences: Rather than helping customers, legacy chatbots and IVR’s often created friction – forcing users through fixed paths, repeating questions. The result: lower client satisfaction, that defeats the original goal of automation.

The Challenge with Legacy Bots in Banking

As consumers grew accustomed to the seamless, intelligent interactions offered by leading tech and e-commerce platforms, expectations in the banking industry followed suit. Static, scripted bots couldn’t keep up. This is why pioneer banks like TBC Uzbekistan are already moving beyond outdated systems. Rather than patching legacy infrastructure, they are embracing advanced Virtual Agents powered by Conversational AI. These future-ready solutions deliver human-like, context-aware engagement and are purpose-built to meet the expectations of modern digital customers. It’s a strategic shift for institutions committed to leading, not lagging, in the next era of banking.

Conversational AI – Persistent and Adaptive

Today’s Virtual Employees, otherwise known as AI agents, built on Conversational AI technologies, enable banks to engage customers through natural, context-aware dialogue – offering responses that feel more human and intuitive. Beyond just improving service, these systems drive measurable gains in efficiency, scalability, and adapt continuously to changing business needs.

What Is Conversational AI Really?

Conversational AI refers to the set of technologies that enable machines to hold human-like conversations. Powered by modern LLMs paired with ASR (Automatic Speech Recognition) and TTS (Text-To-Speech) models, these systems go far beyond scripted responses. They can interpret intent, retain context throughout an interaction, even if it changes midway, and tailor replies in real time. All this being language agnostic, understanding dialects and so on. This capability unlocks far more fluid conversations – helping banks move past the limitations of traditional chatbots and IVRs toward experiences that feel intuitive, responsive, and genuinely helpful.

3 key strengths that make Virtual Employees/AI agents a compelling solution for financial institutions today:

Cost Efficiency

By automating not only high volumes of routine requests but also more complex customer interactions, conversational AI reduces operational costs and allows human agents to focus on complex, high-value interactions. This results in measurable gains in productivity and staffing flexibility.Scalability

AI agents provide on-demand scalability. Unlike human teams, virtual agents don’t require training, onboarding, or ongoing care—they’re ready to go from day one. Whether you're facing peak-season surges or low-activity periods, AI agents can scale up or down in a matter of hours, not weeks. No sick days, no turnover, no hiring bottlenecks. It's workforce elasticity without the operational burden.

Human-Level Dialogue Quality, Fast and Precise

Thanks to large language models and refined orchestration layers, today’s AI agents can carry out conversations that rival those of human operators. Their ability to understand context, intent, and nuance allows them to provide clear, relevant answers without hesitation. When deployed as copilots, they attentively support human agents by listening to the entire exchange, retrieving data from internal systems, and surfacing next-best actions in real time. This boosts accuracy, shortens response time, and removes the burden of multitasking.

Beyond the Chat Window: Two Key Roles of Conversational AI in Banking

While the conversation around Conversational AI often focuses on fully autonomous agents interacting directly with customers, that's only part of the story. In reality, there are two powerful ways this technology is transforming banking operations.

The first is Autonomous Agent Mode where AI takes the lead, interacting directly with customers through voice or text. These autonomous agents handle entire workflows independently, from resolving support queries to managing transactions, without the need for human intervention.

The second is AI Copilot Mode where copilots act as intelligent, behind-the-scenes assistants, mostly operating through text-based interfaces. Rather than engaging customers directly, they support human agents during live interactions by surfacing relevant data, offering personalized suggestions, and summarizing calls while the human agent remains in control.

For example, an AI assistant might prompt a loan officer with next-best actions during a customer consultation or ensure a support agent has all the answers at hand during complex service calls.

Each approach offers distinct advantages depending on the use case. Next, we’ll explore how both models work – and when each is best suited to modern banking needs.

Trends in Financial Services | What are AI Copilots? – Augmenting Human Agents

AI copilots operate quietly but powerfully during live customer interactions. They:

Listen to conversations in real time, interpreting both the agent's and the customer's input.

Recognize intent and understand the context of the conversation as it evolves.

Retrieve relevant information from internal systems and data silos instantly.

Suggest responses or next-best actions to help agents stay efficient and accurate.

Offer icebreakers or prompts to guide the tone and direction of and the dialogue when needed.

Help agents maintain a consistent brand tone throughout the call, preventing emotional drift and ensuring professional, controlled communication.

This real-time support enables agents to focus on high-impact human connection – while the copilot handles the complexity under the hood.

The result is a seamless collaboration between human expertise and machine intelligence. From guiding a call center agent through regulatory-compliant scripts to recommending personalized product offers during a live chat, AI copilots boost accuracy, efficiency, speed and service quality—without removing the human touch. Critically, they operate under direct supervision, ensuring that final decisions remain with trained professionals. It’s not about replacing people—it’s about helping them perform at their best.

Real-World Use Cases in Banking

When deployed thoughtfully, AI copilots offer immediate value across frontline banking operations. Here are four practical ways banks are already putting them to work:

Live Script Suggestions

During customer calls or chats, AI copilots offer real-time prompts – helping agents navigate conversations more effectively and maintain consistency in messaging, tone, and service delivery.Compliance Support

Copilots monitor regulatory frameworks in the background, flagging sensitive topics and guiding employees to stay within approved boundaries – reducing compliance risk without slowing the interaction.CRM and Workflow Automation

Instead of manually updating customer profiles or logging interactions, AI copilots handle administrative tasks automatically – freeing employees to focus on relationship-building and decision-making.Instant Document Retrieval

Whether it's a loan policy, transaction history, or internal knowledge base article, copilots quickly surface relevant documents – cutting down time spent searching and improving first-contact resolution rates. According to Capgemini, banks could optimize up to 66% of the time spent on operations, documentation, compliance, and other onboarding-related activities through AI-powered intelligent transformation and generative AI copilots.

Copilots and Autonomous Agents: The Best of Both Worlds

Copilots and autonomous agents play complementary roles within a unified AI strategy. Autonomous agents are ideal for managing high volumes of routine and moderately complex interactions – delivering consistent, 24/7 service at scale. Copilots, meanwhile, provide real-time support to human agents during more nuanced or high-context conversations – where live judgment, empathy, or personalization elevate the experience. Rather than acting as a fallback, copilots are being used strategically to enhance human performance in moments that matter most. This approach enables banks to combine the power of full automation with intelligent human collaboration – deploying the right capabilities for the right moments across the customer journey.

Trends in Financial Services | What are Autonomous AI Agents? – Fully Independent Virtual Employees

In contrast to AI copilots autonomous AI agents function independently, without the need for human manual oversight. These systems can initiate actions, make decisions, and complete end-to-end tasks in real time, making them a transformative force in the financial services customer relations.

Real-World Use Cases in Banking

Notable applications of Autonomous AI Agents include:

AI-Powered Debt Collection

AI agents manage early-stage collections with persistence and precision – initiating outbound calls, negotiating promises to pay, and reducing operational costs without compromising customer experience.

Read more: AI Debt Collection – How Conversational AI Supercharged Efficiency and Scalability

Sales Tasks

AI agents are redefining banking sales by handling both inbound and outbound activities with speed and precision. Whether it's qualifying incoming leads, following up on abandoned applications, or even initiating proactive outreach like cold calling.

Read more: AI in Financial Services: How Conversational AI is Revolutionizing Banking Sales

24/7 Customer Service

Autonomous agents independently resolve high-volume support requests – checking balances, updating account preferences, or handling KYC processes – delivering consistent, always-on service without escalation.

These implementations not only improve operational efficiency but also directly impact customer retention, proving that reducing service effort leads to dramatically higher loyalty. In line with the latest trends in finance, automation and personalization aren't just efficiencies, they're loyalty drivers.

High Potential, Expertly Delivered

Deploying autonomous AI agents in banking doesn’t have to be daunting – but it does require the right approach. These systems unlock powerful opportunities to automate complex processes, drive operational efficiency, and elevate customer experiences. Naturally, introducing AI into regulated environments comes with specific considerations – from ensuring compliance to managing change and integrating with legacy systems.

That’s where the right partner makes all the difference. As McKinsey points out, scaling AI in banking requires both the right technology and the right execution. We bring both – so your team doesn’t have to choose between innovation and control.

Aiphoria Pro Platform as a Reliable Example

At Aiphoria, we specialize in helping financial institutions deploy AI agents, copilots and autonomous ones, responsibly and at scale. Aiphoria Pro Platform is built with banking-grade reliability, and our team brings deep expertise in navigating regulatory frameworks, minimizing operational risk, and accelerating adoption.

What sets the Aiphoria Pro Platform apart are its three core pillars:

On-premise deployment options for institutions with strict data residency or security requirements,

A modular architecture that allows banks to scale capabilities gradually based on their needs,

And goal-oriented AI scenarios tailored to specific business outcomes such as obtaining the promise to pay, process incoming sales requests, or simply picking up the phone right away.

Whether assisting human agents in co-pilot mode or operating independently as fully autonomous AI agents, Aiphoria Pros dramatically improve efficiency across customer support, mass recruitment, payment reminders and sales. Available across multiple support channels, the platform enables banks to scale without increasing headcount – while maintaining compliance, consistency, and 24/7 availability.

Conclusion

As McKinsey pointed out, banks that embed AI across the customer journey are significantly more likely to see gains in both revenue and customer retention. The future of AI in banking is bright – and it will be shaped by institutions willing to lead. Whether through AI copilots supporting internal teams or autonomous agents engaging customers directly, those who act now will set the standard for the next era of digital banking. At Aiphhoria, we are here to help make that transition a success. Aiphoria Pro Platform is built for cases relevant to the banking industry. It supports complex dialogue flows, integrates seamlessly with core systems, and aligns with strict regulatory and compliance standards. With multilingual capabilities and flexible deployment options Aiphoria ensures conversational AI not only automates and helps cut operational costs, but elevates the experience for the banking customers of the future.

Ready to transform your banking operations with AI? Book a demo

Other Sources:

Matteo Ressa